Rising Cybersecurity Threats

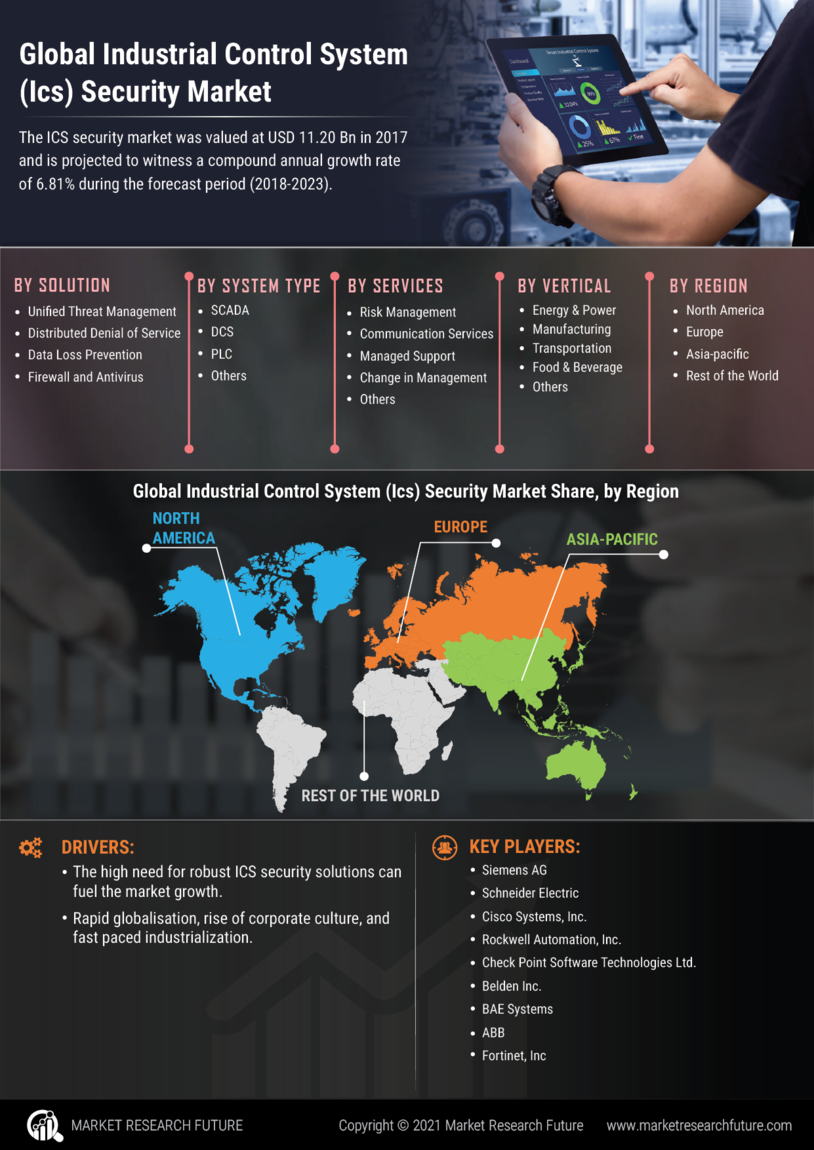

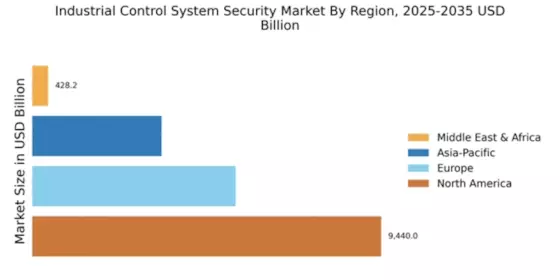

The increasing frequency and sophistication of cyberattacks on critical infrastructure drive the Global Industrial Control System (ICS) Security Market Industry. Organizations are compelled to enhance their security measures to protect against potential breaches that could disrupt operations. For instance, the U.S. Cybersecurity and Infrastructure Security Agency (CISA) has reported a surge in ransomware attacks targeting industrial sectors. This trend underscores the necessity for robust ICS security solutions, as the market is projected to reach 15.2 USD Billion in 2024, reflecting a growing awareness of cybersecurity risks.

Investment in Smart Manufacturing

The shift towards smart manufacturing is a significant driver of the Global Industrial Control System (ICS) Security Market Industry. As industries adopt automation and data analytics, the complexity of ICS increases, necessitating enhanced security measures. Investments in smart manufacturing technologies are expected to escalate, as companies recognize the importance of safeguarding their operations against cyber threats. This trend is likely to contribute to the market's growth, with projections indicating a substantial increase in demand for ICS security solutions in the coming years.

Regulatory Compliance Requirements

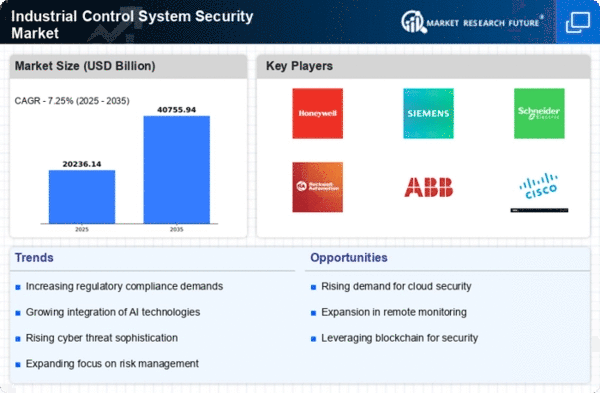

Stringent regulatory frameworks and compliance mandates are pivotal in shaping the Global Industrial Control System (ICS) Security Market Industry. Governments worldwide are implementing regulations that necessitate enhanced security protocols for industrial control systems. For example, the North American Electric Reliability Corporation (NERC) has established standards that require utilities to adopt cybersecurity measures. Compliance with these regulations not only mitigates risks but also fosters trust among stakeholders. As a result, the market is expected to grow significantly, with projections indicating a value of 30 USD Billion by 2035.

Integration of IoT in Industrial Systems

The integration of Internet of Things (IoT) technologies into industrial systems is transforming the Global Industrial Control System (ICS) Security Market Industry. IoT devices, while enhancing operational efficiency, also introduce new vulnerabilities that necessitate advanced security measures. The proliferation of connected devices in sectors such as manufacturing and energy amplifies the need for comprehensive ICS security solutions. As organizations increasingly adopt IoT, the market is likely to experience a compound annual growth rate (CAGR) of 6.35% from 2025 to 2035, reflecting the growing demand for secure and resilient industrial environments.

Emergence of Advanced Security Technologies

The emergence of advanced security technologies, such as artificial intelligence and machine learning, is reshaping the Global Industrial Control System (ICS) Security Market Industry. These technologies offer innovative solutions for threat detection and response, enabling organizations to proactively address vulnerabilities in their ICS. By leveraging AI-driven analytics, companies can enhance their security posture and mitigate risks associated with cyber threats. As these technologies gain traction, the market is poised for growth, driven by the need for sophisticated security measures in an increasingly complex industrial landscape.