Growth in Industrial Production

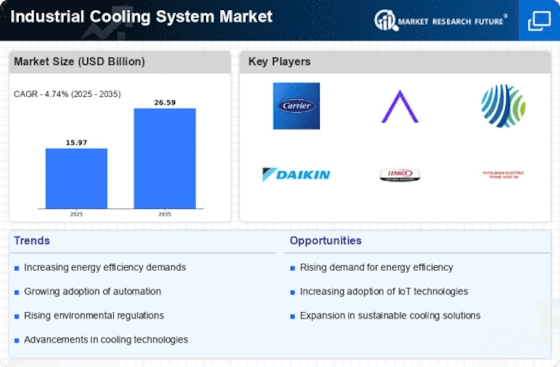

The Industrial Cooling System Market is poised for growth, driven by an increase in industrial production across various sectors. As manufacturing activities ramp up, the need for effective cooling solutions becomes paramount to maintain optimal operational conditions. Data indicates that the manufacturing sector is projected to grow at a compound annual growth rate of approximately 4% over the next few years. This growth necessitates advanced cooling systems that can handle increased heat loads and ensure equipment longevity. Consequently, manufacturers are investing in innovative cooling technologies that can support higher production rates while maintaining energy efficiency. This trend underscores the critical role of cooling systems in the overall productivity of the Industrial Cooling System Market.

Increasing Focus on Sustainability

The Industrial Cooling System Market is increasingly aligning with sustainability initiatives as industries recognize the importance of reducing their carbon footprint. Companies are actively seeking cooling solutions that not only provide effective temperature control but also contribute to environmental sustainability. This shift is reflected in the growing demand for systems that utilize natural refrigerants and have lower energy consumption. Market analysis indicates that the adoption of sustainable cooling technologies could lead to a reduction in energy costs by up to 20%. As sustainability becomes a core business strategy, the Industrial Cooling System Market is expected to see a rise in the development and implementation of eco-friendly cooling solutions.

Rising Demand for Energy Efficiency

The Industrial Cooling System Market is experiencing a notable shift towards energy-efficient solutions. As industries strive to reduce operational costs and minimize environmental impact, the demand for cooling systems that utilize less energy is increasing. According to recent data, energy-efficient cooling systems can reduce energy consumption by up to 30%, which is particularly appealing to sectors such as manufacturing and data centers. This trend is likely to drive innovation in cooling technologies, leading to the development of systems that not only meet regulatory standards but also enhance overall productivity. The emphasis on energy efficiency is expected to shape the future landscape of the Industrial Cooling System Market, as companies seek to balance performance with sustainability.

Technological Innovations in Cooling Solutions

The Industrial Cooling System Market is witnessing a surge in technological innovations that enhance cooling efficiency and performance. Advancements in smart technologies, such as IoT and AI, are enabling real-time monitoring and optimization of cooling systems. These innovations allow for predictive maintenance, reducing downtime and operational costs. Furthermore, the integration of advanced materials and designs is leading to the development of more compact and efficient cooling units. Market data suggests that the adoption of smart cooling technologies could increase system efficiency by up to 25%. As industries continue to embrace these technological advancements, the Industrial Cooling System Market is likely to evolve, offering more sophisticated and efficient cooling solutions.

Regulatory Compliance and Environmental Standards

The Industrial Cooling System Market is significantly influenced by stringent regulatory compliance and environmental standards. Governments worldwide are implementing regulations aimed at reducing greenhouse gas emissions and promoting sustainable practices. As a result, industries are compelled to adopt cooling systems that comply with these regulations. For instance, the introduction of the F-Gas Regulation in various regions has led to a shift towards low-GWP refrigerants in cooling systems. This regulatory landscape is likely to drive demand for innovative cooling solutions that not only meet compliance requirements but also enhance operational efficiency. The need for compliance is expected to be a key driver in the evolution of the Industrial Cooling System Market, as companies seek to align with environmental goals.