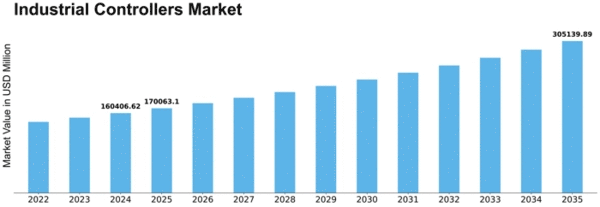

Industrial Controllers Size

Industrial Controllers Market Growth Projections and Opportunities

The Industrial Controllers Market is significantly influenced by a variety of factors that collectively drive its growth and evolution. One key driver is the increasing emphasis on industrial automation and the adoption of Industry 4.0 principles. As manufacturing processes become more sophisticated and interconnected, the demand for efficient control systems and automation solutions rises. Industrial controllers, serving as the central intelligence in automated systems, play a pivotal role in optimizing production, enhancing efficiency, and facilitating real-time decision-making.

Technological advancements are fundamental to the continuous development of the Industrial Controllers Market. The evolution of programmable logic controllers (PLCs), distributed control systems (DCS), and programmable automation controllers (PACs) contributes to improved functionalities, connectivity, and integration capabilities. These advancements enable seamless communication between various components in industrial networks, fostering interoperability and enabling a more flexible and responsive manufacturing environment.

The ongoing trend of digital transformation and the Industrial Internet of Things (IIoT) significantly impact the Industrial Controllers Market. The integration of sensors, actuators, and smart devices into industrial processes generates vast amounts of data. Industrial controllers, equipped with advanced communication protocols and data processing capabilities, serve as the backbone for collecting, analyzing, and leveraging this data for predictive maintenance, process optimization, and overall operational efficiency.

The manufacturing sector's increasing focus on energy efficiency and sustainability is another driving factor for the Industrial Controllers Market. Industrial controllers contribute to optimizing energy consumption in manufacturing processes by regulating equipment operation and ensuring optimal resource utilization. The ability to monitor and control energy usage aligns with global sustainability goals and regulatory initiatives, driving the adoption of energy-efficient industrial control solutions.

The demand for safety and compliance in industrial operations influences the Industrial Controllers Market. Stringent safety standards and regulations in industries such as chemicals, pharmaceuticals, and oil and gas necessitate the implementation of robust safety control systems. Industrial controllers with integrated safety features, such as safety PLCs and safety-rated PACs, provide the necessary functionality to meet safety requirements and protect both personnel and assets.

The aerospace and automotive industries contribute significantly to the Industrial Controllers Market. In these industries, precision control and high-speed data processing are essential for manufacturing complex components and ensuring product quality. Industrial controllers play a crucial role in robotics, machine control, and overall process automation in these sectors, supporting advanced manufacturing practices and maintaining competitiveness.

Market dynamics are also influenced by the geographical expansion of manufacturing activities. The growth of emerging economies and the establishment of new manufacturing facilities contribute to increased demand for industrial controllers. As industries in regions such as Asia-Pacific expand and modernize, the need for advanced control systems becomes more pronounced, driving market growth.

Market competition and the presence of key players contribute to the dynamism of the Industrial Controllers Market. Established automation and control system manufacturers, as well as new entrants, actively invest in research and development to introduce innovative industrial controller solutions. Collaborations, partnerships, and acquisitions are common strategies employed by market players to enhance their product portfolios and gain a competitive edge. This competitive landscape fosters continuous innovation and ensures that industrial controllers remain at the forefront of technological advancements.

Leave a Comment