Regulatory Compliance

Regulatory compliance is a crucial factor influencing the Global Industrial Controllers Market Industry. Governments worldwide are implementing stringent regulations to ensure safety, quality, and environmental protection in industrial operations. Compliance with these regulations necessitates the adoption of advanced control systems that can monitor and report on various operational parameters. For instance, industries must adhere to standards set by organizations such as the International Organization for Standardization. This regulatory landscape drives the demand for sophisticated industrial controllers, as companies seek to avoid penalties and enhance their operational integrity.

Emerging Markets Growth

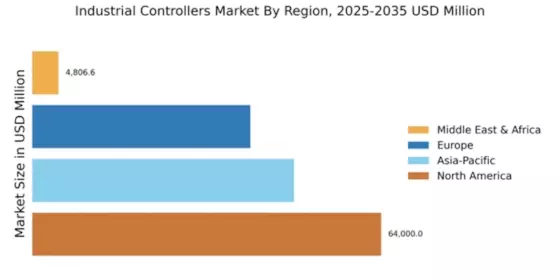

The Global Industrial Controllers Market Industry is poised for growth, particularly in emerging markets. Countries in Asia-Pacific and Latin America are witnessing rapid industrialization, leading to increased investments in manufacturing and infrastructure. This growth presents opportunities for industrial controllers, as businesses in these regions seek to modernize their operations. For example, the expansion of manufacturing hubs in India and Brazil is driving demand for advanced control systems. As these markets develop, the Global Industrial Controllers Market is expected to benefit from increased adoption of automation technologies, further propelling its growth trajectory.

Focus on Energy Efficiency

Energy efficiency has emerged as a pivotal driver in the Global Industrial Controllers Market Industry. Companies are increasingly prioritizing sustainable practices to reduce operational costs and minimize environmental impact. Advanced industrial controllers enable precise monitoring and control of energy consumption, leading to significant savings. For example, industries that implement energy-efficient control systems can reduce energy usage by up to 30%. This focus on sustainability not only aligns with global environmental goals but also enhances the competitiveness of businesses in the market, contributing to a projected CAGR of 6.02% from 2025 to 2035.

Technological Advancements

The Global Industrial Controllers Market Industry is experiencing a surge in demand driven by rapid technological advancements. Innovations in automation, artificial intelligence, and the Internet of Things are reshaping industrial processes. For instance, the integration of smart sensors and advanced control algorithms enhances operational efficiency and reduces downtime. This trend is evident as industries increasingly adopt these technologies to optimize production. As a result, the market is projected to reach 160.4 USD Billion in 2024, reflecting a growing reliance on sophisticated control systems to meet the demands of modern manufacturing.

Rising Demand for Automation

The Global Industrial Controllers Market Industry is significantly influenced by the rising demand for automation across various sectors. Industries such as manufacturing, oil and gas, and pharmaceuticals are increasingly automating their processes to improve productivity and reduce labor costs. This shift is evident in the growing adoption of programmable logic controllers and distributed control systems. As companies seek to enhance operational efficiency, the market is expected to grow substantially, with projections indicating a value of 305.1 USD Billion by 2035. This trend underscores the critical role of industrial controllers in facilitating seamless automation.