Sustainability Initiatives

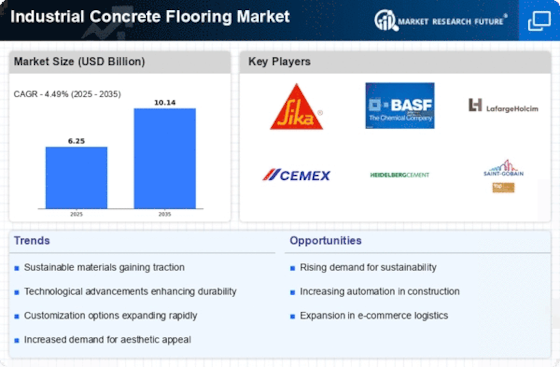

The increasing emphasis on sustainability within the construction sector appears to be a pivotal driver for the Industrial Concrete Flooring Market. As industries strive to reduce their carbon footprints, the demand for eco-friendly flooring solutions has surged. Concrete flooring, known for its durability and low maintenance, aligns well with these sustainability goals. Moreover, the use of recycled materials in concrete production is gaining traction, further enhancing its appeal. According to recent data, the market for sustainable flooring solutions is projected to grow at a compound annual growth rate of approximately 6% over the next five years. This trend indicates a robust shift towards environmentally responsible practices, positioning the Industrial Concrete Flooring Market favorably in the evolving landscape.

Technological Advancements

Technological integration within the construction industry is significantly influencing the Industrial Concrete Flooring Market. Innovations such as advanced mixing techniques, improved curing methods, and the incorporation of smart technologies are enhancing the performance and longevity of concrete floors. For instance, the adoption of self-leveling concrete and high-performance additives has led to increased efficiency in installation processes. Furthermore, the integration of IoT devices for monitoring floor conditions is becoming more prevalent, allowing for proactive maintenance and reducing downtime. Market data suggests that the adoption of these technologies could lead to a 15% increase in operational efficiency for businesses utilizing industrial concrete flooring solutions. This technological evolution is likely to drive growth and competitiveness within the Industrial Concrete Flooring Market.

Customization and Aesthetic Appeal

The demand for customized flooring solutions is emerging as a significant driver in the Industrial Concrete Flooring Market. As businesses seek to create unique environments that reflect their brand identity, the ability to customize concrete flooring has become increasingly important. Decorative concrete options, such as stamped, stained, or polished finishes, allow for a wide range of aesthetic choices. This trend is particularly evident in sectors such as retail and hospitality, where visual appeal plays a crucial role in customer experience. Market analysis indicates that the decorative concrete segment is expected to witness a growth rate of around 8% annually, highlighting the increasing importance of aesthetics in industrial settings. Consequently, the Industrial Concrete Flooring Market is adapting to meet these evolving consumer preferences.

Economic Growth and Industrial Expansion

The ongoing economic growth and industrial expansion are likely to serve as key drivers for the Industrial Concrete Flooring Market. As various sectors, including manufacturing, logistics, and warehousing, continue to expand, the demand for durable and resilient flooring solutions is expected to rise. Concrete flooring is favored for its ability to withstand heavy loads and high traffic, making it an ideal choice for industrial applications. Recent economic indicators suggest a steady increase in industrial output, which correlates with heightened construction activities. This trend is anticipated to bolster the Industrial Concrete Flooring Market, as businesses invest in infrastructure to support their growth objectives. The projected increase in industrial activities could lead to a market growth rate of approximately 5% over the next few years.

Regulatory Compliance and Safety Standards

The stringent regulatory compliance and safety standards imposed on industrial facilities are driving the demand for high-quality flooring solutions within the Industrial Concrete Flooring Market. As safety regulations become more rigorous, businesses are compelled to invest in flooring that meets these standards. Concrete flooring is often preferred due to its non-slip properties and resistance to fire and chemicals, making it suitable for various industrial environments. Compliance with safety regulations not only protects employees but also minimizes liability risks for businesses. Market data indicates that the emphasis on safety and compliance is expected to contribute to a 7% growth in the industrial flooring sector over the next few years. This focus on regulatory adherence is likely to enhance the reputation and reliability of the Industrial Concrete Flooring Market.