North America : Market Leader in Innovation

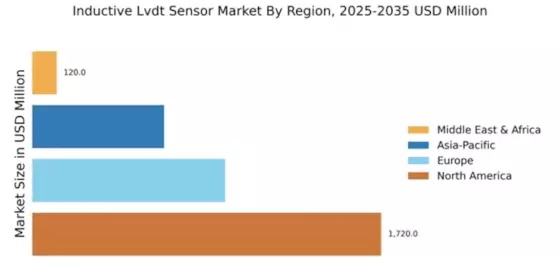

North America continues to lead the Inductive LVDT sensor market, holding a significant share of 1720.0 million in 2024. The region's growth is driven by advancements in automation, aerospace, and defense sectors, alongside increasing demand for precision measurement technologies. Regulatory support for manufacturing and innovation further catalyzes market expansion, ensuring compliance with safety and quality standards.

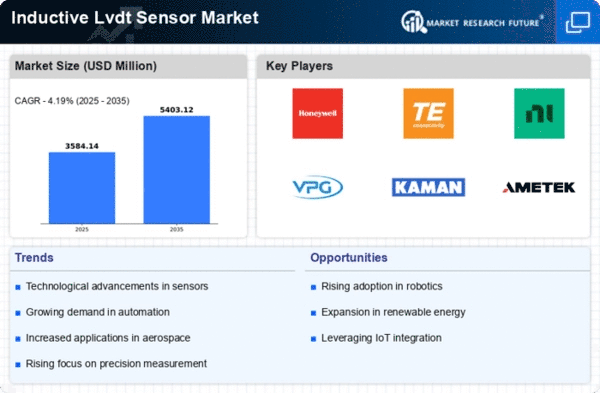

The competitive landscape is robust, with key players like Honeywell, TE Connectivity, and National Instruments dominating the market. The U.S. stands out as a primary contributor, leveraging its technological prowess and investment in R&D. The presence of established companies fosters a dynamic environment, encouraging innovation and collaboration, which is essential for maintaining market leadership.

Europe : Emerging Market with Growth Potential

Europe's Inductive LVDT sensor market is valued at 950.0 million, reflecting a growing demand driven by industrial automation and renewable energy sectors. The region benefits from stringent regulations that promote high-quality manufacturing standards, enhancing the reliability of LVDT sensors. Additionally, the push for smart manufacturing solutions is expected to further boost market growth, aligning with the EU's sustainability goals.

Leading countries such as Germany, France, and the UK are at the forefront of this market, supported by key players like Siemens and Micro-Epsilon. The competitive landscape is characterized by innovation and strategic partnerships, enabling companies to enhance their product offerings. The presence of advanced manufacturing facilities and a skilled workforce positions Europe as a significant player in The Inductive Lvdt Sensor.

Asia-Pacific : Rapidly Growing Industrial Sector

The Asia-Pacific region, with a market size of 650.0 million, is witnessing rapid growth in the Inductive LVDT sensor market, driven by increasing industrialization and urbanization. Countries like China and India are investing heavily in infrastructure and manufacturing, creating a surge in demand for precision measurement tools. Government initiatives aimed at boosting manufacturing capabilities further support this growth trajectory, making the region a focal point for LVDT sensor adoption.

China leads the market, supported by a strong manufacturing base and a growing emphasis on automation. The competitive landscape features both local and international players, including Vishay Precision Group and Kaman Corporation. As industries evolve, the demand for advanced LVDT sensors is expected to rise, fostering innovation and enhancing product development across the region.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa region, with a market size of 120.0 million, is gradually emerging in the Inductive LVDT sensor market. The growth is primarily driven by increasing investments in infrastructure and industrial projects, particularly in the Gulf Cooperation Council (GCC) countries. However, challenges such as economic fluctuations and regulatory hurdles may hinder rapid market expansion. Nonetheless, the focus on modernization and technological adoption is expected to create opportunities for growth.

Countries like the UAE and South Africa are leading the way, with a growing number of projects requiring precision measurement solutions. The competitive landscape is still developing, with opportunities for both local and international players to establish a foothold. As the region continues to invest in technology and infrastructure, the demand for LVDT sensors is likely to increase, paving the way for future growth.