Growing Demand for Fresh Produce

The Indoor Farming Technology Market is witnessing a surge in demand for fresh, locally grown produce. Consumers are increasingly prioritizing food quality and sustainability, leading to a shift in purchasing behaviors. This trend is particularly evident in urban areas, where access to fresh produce can be limited. As a result, indoor farming solutions are becoming more appealing, as they can provide fresh vegetables and herbs year-round, regardless of external weather conditions. Market data indicates that the demand for fresh produce is expected to grow by 20% over the next five years, significantly impacting the Indoor Farming Technology Market.

Government Support and Incentives

Government initiatives and incentives play a crucial role in the growth of the Indoor Farming Technology Market. Many governments are recognizing the potential of indoor farming to address food security and environmental concerns. As a result, they are implementing policies that support research and development, provide financial assistance, and promote sustainable practices. For example, grants and subsidies for energy-efficient technologies are becoming more common, encouraging farmers to adopt indoor farming solutions. This supportive regulatory environment is likely to stimulate investment and innovation within the Indoor Farming Technology Market.

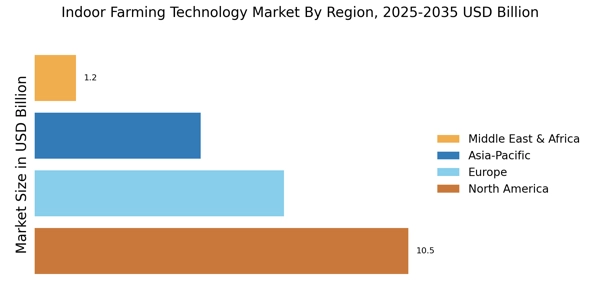

Urbanization and Space Constraints

Urbanization is a significant driver of the Indoor Farming Technology Market, as cities face increasing space constraints for traditional agriculture. The growing urban population necessitates innovative solutions to meet food demands without expanding agricultural land. Indoor farming provides an effective response to this challenge, allowing for the cultivation of crops in limited spaces, such as rooftops and abandoned buildings. This trend is expected to lead to a 25% increase in urban indoor farms by 2030, reflecting the adaptability of indoor farming technologies to urban environments. Consequently, the Indoor Farming Technology Market is poised for substantial growth.

Environmental Concerns and Sustainability

The Indoor Farming Technology Market is increasingly influenced by environmental concerns and the need for sustainable agricultural practices. As climate change and resource depletion become pressing issues, indoor farming offers a viable solution by utilizing less water and land compared to traditional farming methods. Moreover, the ability to grow crops in controlled environments reduces the reliance on pesticides and herbicides, aligning with consumer preferences for organic produce. Market analysis suggests that the sustainability aspect of indoor farming could drive a 15% increase in market share within the next few years, highlighting its importance in the Indoor Farming Technology Market.

Technological Advancements in Indoor Farming

The Indoor Farming Technology Market is experiencing rapid technological advancements that enhance productivity and efficiency. Innovations such as automated systems, artificial intelligence, and IoT integration are transforming traditional farming practices. For instance, the use of sensors and data analytics allows for real-time monitoring of crop health and environmental conditions, leading to optimized growth conditions. According to recent data, the adoption of these technologies is projected to increase crop yields by up to 30%. This trend not only improves the economic viability of indoor farms but also attracts investment, further propelling the Indoor Farming Technology Market.