Rising Cyber Threats

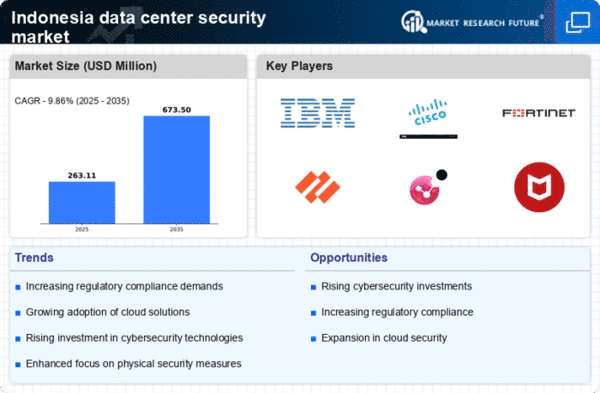

The data center-security market in Indonesia is experiencing a surge in demand due to the increasing frequency and sophistication of cyber threats. As organizations digitize their operations, the risk of data breaches and cyberattacks escalates. Reports indicate that cybercrime costs businesses in Indonesia approximately $1.5 billion annually, highlighting the urgent need for robust security measures. This environment compels companies to invest in advanced security solutions, including firewalls, intrusion detection systems, and encryption technologies. The growing awareness of these threats drives the data center-security market, as businesses seek to protect sensitive information and maintain customer trust. Consequently, the market is projected to grow at a CAGR of 12% over the next five years, reflecting the critical importance of cybersecurity in safeguarding data centers.

Increased Cloud Adoption

The rapid adoption of cloud computing in Indonesia significantly influences the data center-security market. As businesses migrate to cloud-based solutions, they face new security challenges that necessitate enhanced protective measures. The cloud services market in Indonesia is expected to reach $2 billion by 2026, indicating a substantial shift in how organizations manage their data. This transition creates a pressing need for security solutions that can effectively protect data stored in the cloud. Consequently, the data center-security market is adapting to these changes by offering tailored solutions that address the unique vulnerabilities associated with cloud environments. This trend not only drives market growth but also encourages innovation in security technologies, ensuring that businesses can securely leverage cloud capabilities.

Growing Regulatory Landscape

The evolving regulatory landscape in Indonesia plays a pivotal role in shaping the data center-security market. With the introduction of stricter data protection laws, organizations are compelled to enhance their security protocols to comply with legal requirements. The Personal Data Protection Law, enacted in 2020, mandates that companies implement robust security measures to safeguard personal data. Failure to comply can result in hefty fines, which may reach up to 2% of annual revenue. This regulatory pressure drives investments in security solutions, as businesses strive to avoid penalties and protect their reputations. As a result, the data center-security market is likely to expand, with companies prioritizing compliance-driven security measures to mitigate risks associated with non-compliance.

Focus on Business Continuity Planning

The emphasis on business continuity planning is becoming increasingly relevant in the data center-security market in Indonesia. Organizations recognize that disruptions, whether due to cyber incidents or natural disasters, can have severe consequences on operations. As a result, there is a growing focus on developing comprehensive disaster recovery and business continuity strategies. Companies are investing in redundant systems, backup solutions, and incident response plans to ensure operational resilience. This trend is expected to propel the data center-security market, as businesses seek to mitigate risks and ensure uninterrupted service delivery. The market is likely to see a growth rate of 10% over the next few years, driven by the necessity for organizations to safeguard their operations against unforeseen disruptions.

Demand for Advanced Security Technologies

The data center-security market in Indonesia is witnessing a growing demand for advanced security technologies. As cyber threats evolve, traditional security measures are often insufficient to protect sensitive data. Organizations are increasingly seeking innovative solutions such as artificial intelligence, machine learning, and behavioral analytics to enhance their security posture. These technologies enable real-time threat detection and response, significantly reducing the risk of data breaches. The market for advanced security technologies is projected to grow by 15% annually, reflecting the urgency for businesses to adopt cutting-edge solutions. This trend not only drives the data center-security market but also fosters a competitive landscape where companies must continuously innovate to stay ahead of emerging threats.