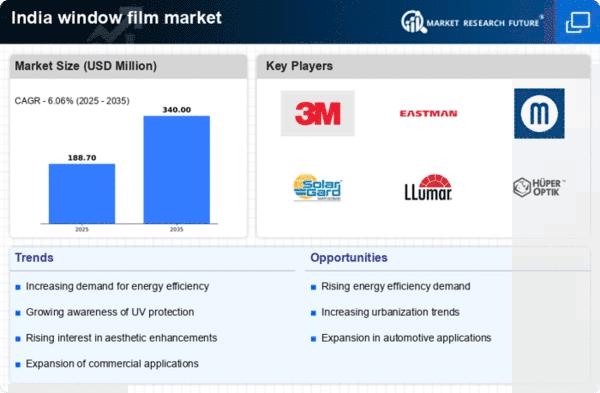

The window film market in India is characterized by a dynamic competitive landscape, driven by increasing demand for energy-efficient solutions and enhanced aesthetic appeal in residential and commercial spaces. Key players such as 3M (US), Eastman Chemical Company (US), and V-KOOL (SG) are strategically positioned to leverage innovation and sustainability as core components of their operational focus. 3M (US) emphasizes its commitment to research and development, continuously introducing advanced window film technologies that enhance energy efficiency and UV protection. Meanwhile, Eastman Chemical Company (US) has been focusing on expanding its product portfolio to include eco-friendly options, aligning with the growing consumer preference for sustainable products. V-KOOL (SG) appears to be concentrating on regional expansion, enhancing its distribution networks to capture a larger market share in India, thereby intensifying the competitive environment.

In terms of business tactics, companies are increasingly localizing manufacturing to reduce costs and improve supply chain efficiency. This approach not only mitigates logistical challenges but also allows for quicker response times to market demands. The competitive structure of the market is moderately fragmented, with several players vying for market share. However, the collective influence of major companies like 3M (US) and Eastman Chemical Company (US) suggests a trend towards consolidation, as these firms seek to enhance their competitive edge through strategic partnerships and acquisitions.

In October 2025, 3M (US) announced the launch of a new line of window films designed specifically for the Indian market, featuring enhanced thermal insulation properties. This strategic move is likely to cater to the increasing demand for energy-efficient solutions in the region, positioning 3M (US) as a leader in innovation. The introduction of this product line not only reinforces 3M's commitment to sustainability but also aligns with the Indian government's initiatives to promote energy conservation.

In September 2025, Eastman Chemical Company (US) entered into a partnership with a local manufacturer to produce window films using recycled materials. This collaboration is indicative of a broader trend towards sustainability within the industry, as it allows Eastman to tap into the growing market for eco-friendly products while also reducing its carbon footprint. Such initiatives may enhance brand loyalty among environmentally conscious consumers, thereby strengthening Eastman's market position.

In August 2025, V-KOOL (SG) expanded its distribution network by partnering with several regional retailers across India. This strategic action is expected to enhance V-KOOL's market penetration and accessibility, allowing the company to better serve the diverse needs of Indian consumers. By increasing its presence in local markets, V-KOOL (SG) is likely to gain a competitive advantage over rivals who may not have the same level of regional engagement.

As of November 2025, the window film market is witnessing trends that emphasize digitalization, sustainability, and the integration of advanced technologies such as AI. Companies are increasingly forming strategic alliances to enhance their product offerings and market reach. The competitive differentiation is shifting from price-based competition to a focus on innovation, technology, and supply chain reliability. This evolution suggests that firms that prioritize sustainable practices and technological advancements will likely emerge as leaders in the market.