Integration of Advanced Features

The walkie talkie market is witnessing a transformation with the integration of advanced features such as Bluetooth connectivity, GPS tracking, and enhanced battery life. These innovations cater to the evolving needs of users across various sectors, including construction, hospitality, and event management. As businesses seek to improve communication efficiency, the demand for feature-rich walkie talkies is likely to increase. The market is projected to grow by approximately 6% over the next few years, as companies recognize the value of investing in modern communication tools. The walkie talkie market is thus adapting to technological advancements, ensuring that users have access to devices that meet their operational requirements.

Growing Demand in Security Services

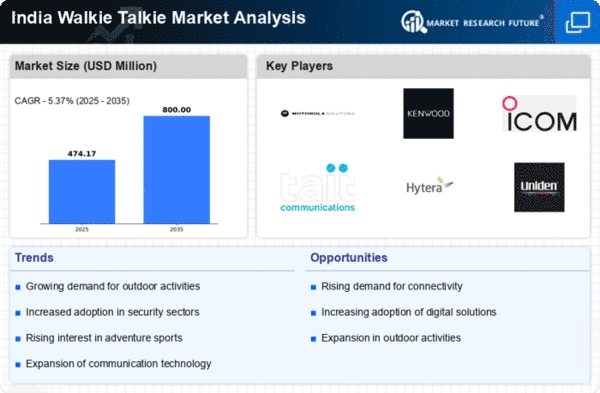

The walkie talkie market in India is experiencing a notable surge in demand, particularly within the security services sector. As urbanization accelerates, the need for effective communication tools in security operations becomes paramount. Security personnel require reliable devices to coordinate activities, especially in high-risk environments. The market is projected to grow at a CAGR of approximately 8% over the next five years, driven by the increasing number of private security agencies. This growth indicates a shift towards more sophisticated communication solutions, as traditional methods become inadequate. The walkie talkie market is thus poised to benefit from this trend, as companies seek to enhance operational efficiency and ensure safety protocols are adhered to in various settings.

Rising Popularity in Event Management

The walkie talkie market is experiencing growth due to its rising popularity in the event management sector. As events become more complex and require meticulous coordination, the demand for reliable communication tools has surged. Walkie talkies facilitate real-time communication among event staff, ensuring smooth operations and quick responses to any issues that may arise. The market is projected to expand by approximately 7% over the next few years, as event organizers increasingly recognize the importance of effective communication. This trend highlights the significance of the walkie talkie market in enhancing the overall efficiency and success of various events, from corporate gatherings to large-scale festivals.

Expansion of Outdoor Recreational Activities

The rise in outdoor recreational activities in India is significantly influencing the walkie talkie market. With an increasing number of individuals engaging in trekking, camping, and adventure sports, the demand for reliable communication devices is on the rise. Walkie talkies provide a practical solution for maintaining contact in remote areas where mobile signals may be weak or non-existent. The market is expected to witness a growth rate of around 7% annually, as outdoor enthusiasts prioritize safety and connectivity. This trend highlights the importance of the walkie talkie market in catering to the needs of adventure seekers, ensuring they remain connected while exploring the great outdoors.

Government Initiatives for Infrastructure Development

Government initiatives aimed at infrastructure development in India are creating a favorable environment for the walkie talkie market. As projects in sectors such as transportation, energy, and urban development expand, the need for effective communication among teams becomes critical. Walkie talkies serve as essential tools for on-site coordination, enabling workers to communicate seamlessly in challenging environments. The market is anticipated to grow at a rate of 5% annually, driven by increased investments in infrastructure projects. This trend underscores the role of the walkie talkie market in supporting the operational needs of various sectors, ensuring that communication remains uninterrupted during critical phases of development.