Integration with IoT Devices

The integration of visual positioning systems with Internet of Things (IoT) devices is transforming The India visual positioning system market. As IoT adoption accelerates across various sectors, including agriculture, healthcare, and manufacturing, the need for precise location data becomes paramount. Visual positioning systems can enhance the functionality of IoT devices by providing accurate spatial information, enabling better decision-making and operational efficiency. This synergy between visual positioning and IoT is expected to create new opportunities for innovation and growth within the market.

Government Initiatives and Support

The Indian government has been actively promoting the adoption of advanced technologies, including visual positioning systems, through various initiatives. Programs such as Digital India aim to enhance technological infrastructure across the nation. The government has allocated substantial funds for smart city projects, which often incorporate visual positioning systems to improve urban mobility and infrastructure management. This support is expected to stimulate growth in The India visual positioning system market, as public and private sectors collaborate to implement these technologies in urban planning and development.

Growing Demand for Navigation Solutions

The increasing need for accurate navigation solutions in urban areas drives The India visual positioning system market. With the rapid urbanization in cities like Mumbai and Delhi, the demand for precise location services has surged. According to government data, the urban population in India is projected to reach 600 million by 2031, necessitating advanced navigation systems. Visual positioning systems offer enhanced accuracy over traditional GPS, making them essential for applications in transportation, logistics, and personal navigation. This growing demand is likely to propel investments in visual positioning technologies, thereby expanding the market further.

Rise of E-commerce and Delivery Services

The exponential growth of e-commerce in India has created a pressing need for efficient logistics and delivery solutions, thereby boosting the India visual positioning system market. With online retail sales projected to reach USD 200 billion by 2026, companies are increasingly relying on visual positioning systems to optimize delivery routes and enhance customer experience. These systems provide real-time tracking and accurate location data, which are crucial for timely deliveries. As e-commerce continues to expand, the demand for visual positioning technologies is likely to increase, driving market growth.

Advancements in Augmented Reality Technologies

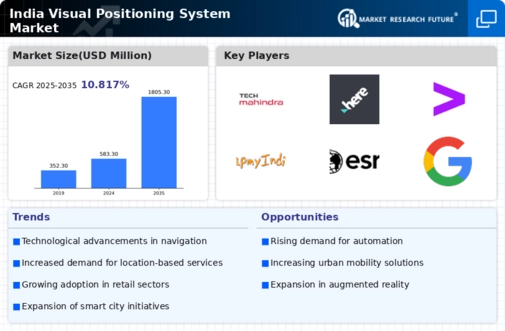

The advancements in augmented reality (AR) technologies are significantly influencing the India visual positioning system market. As AR applications gain traction in sectors such as retail, education, and tourism, the demand for accurate visual positioning systems is likely to increase. These systems enable AR experiences by providing precise location data, enhancing user engagement and interaction. With the Indian AR market projected to grow at a CAGR of 30% over the next few years, the visual positioning system market is poised to benefit from this trend, as businesses seek to leverage AR for competitive advantage.