Growth of E-Learning Platforms

The proliferation of e-learning platforms in India is significantly impacting the virtual networking market. With the increasing adoption of online education, educational institutions and training providers are seeking effective virtual networking solutions to facilitate remote learning. The e-learning market in India is projected to reach $10 billion by 2025, indicating a robust demand for virtual networking tools that support interactive and engaging learning experiences. As educational institutions invest in technology to enhance their online offerings, the virtual networking market is expected to benefit from this trend. The integration of features such as video conferencing, collaborative tools, and real-time feedback mechanisms is likely to drive innovation within the virtual networking market, catering to the evolving needs of educators and learners alike.

Increased Focus on Cybersecurity

The virtual networking market in India is witnessing an increased focus on cybersecurity, driven by the rising number of cyber threats and data breaches. Organizations are becoming more aware of the vulnerabilities associated with virtual networking solutions, prompting them to invest in advanced security measures. Recent statistics indicate that cybercrime in India has surged by over 30% in the past year, highlighting the urgent need for secure networking solutions. As a result, companies are prioritizing cybersecurity in their virtual networking strategies, leading to the development of more secure platforms and protocols. This heightened emphasis on security is likely to shape the virtual networking market, as businesses seek to protect sensitive information and maintain compliance with regulatory standards.

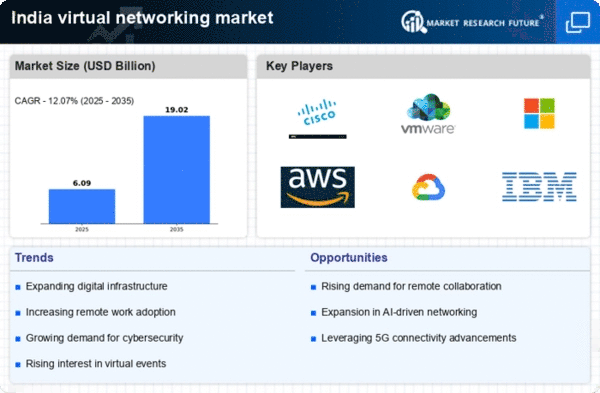

Expansion of Digital Infrastructure

India's ongoing expansion of digital infrastructure is a critical driver for the virtual networking market. The government's initiatives to enhance internet connectivity, particularly in rural areas, are fostering an environment conducive to the adoption of virtual networking solutions. With the aim of achieving 100% broadband penetration by 2025, the Indian government is investing heavily in telecommunications infrastructure. This investment is likely to result in a significant increase in internet users, projected to reach over 900 million by the end of 2025. As more individuals and businesses gain access to high-speed internet, the demand for virtual networking tools is expected to rise, enabling enhanced collaboration and communication across various sectors. This growth in digital infrastructure is a pivotal factor influencing the virtual networking market in India.

Rising Demand for Remote Work Solutions

The virtual networking market in India is experiencing a notable surge in demand for remote work solutions. As organizations increasingly adopt flexible work arrangements, the need for robust virtual networking tools has become paramount. According to recent data, approximately 70% of Indian companies have implemented remote work policies, driving the necessity for secure and efficient networking solutions. This trend is likely to continue, as businesses recognize the benefits of remote work in enhancing productivity and employee satisfaction. Consequently, the virtual networking market is poised for growth, with companies investing in technologies that facilitate seamless communication and collaboration among remote teams. The emphasis on user-friendly interfaces and reliable connectivity is expected to shape the future of the virtual networking market in India.

Emergence of Startups and Innovation Hubs

The emergence of startups and innovation hubs across India is serving as a catalyst for the virtual networking market. With a burgeoning startup ecosystem, there is a growing demand for networking solutions that facilitate collaboration and connectivity among entrepreneurs. Recent reports suggest that India is home to over 50,000 startups, many of which are leveraging virtual networking tools to enhance their operations and reach. This trend is likely to continue, as startups seek to establish themselves in competitive markets and require efficient communication channels. The virtual networking market is expected to evolve in response to the unique needs of these startups, fostering innovation and collaboration within the entrepreneurial landscape.