Rising Pet Ownership

The veterinary laboratory-testing market in India is experiencing growth due to the increasing number of pet owners. As more households adopt pets, the demand for veterinary services, including laboratory testing, rises. According to recent estimates, pet ownership in India has surged by approximately 30% over the past five years. This trend indicates a growing awareness among pet owners regarding the health and well-being of their animals. Consequently, veterinary clinics are expanding their services to include comprehensive laboratory testing, which is essential for diagnosing and treating various health conditions. The rising pet population is likely to drive the demand for advanced diagnostic tools and laboratory services, thereby positively impacting the veterinary laboratory-testing market in India.

Increase in Livestock Farming

The veterinary laboratory-testing market is experiencing growth due to the rise in livestock farming in India. As the demand for animal products such as milk, meat, and eggs increases, farmers are becoming more aware of the importance of maintaining the health of their livestock. This awareness drives the need for regular health assessments and laboratory testing to prevent disease outbreaks and ensure optimal productivity. The livestock sector is projected to grow at a CAGR of approximately 8% over the next few years, which will likely lead to an increased demand for veterinary laboratory services. Consequently, veterinary laboratories are expanding their offerings to cater to the needs of livestock farmers, thereby enhancing the overall market landscape.

Growing Awareness of Animal Health

There is a notable increase in awareness regarding animal health among pet owners in India, which is positively influencing the veterinary laboratory-testing market. Pet owners are becoming more informed about the importance of regular health check-ups and preventive care for their animals. This shift in mindset is leading to a higher demand for laboratory testing services, as owners seek to ensure their pets receive timely diagnoses and appropriate treatments. The veterinary laboratory-testing market is likely to benefit from this trend, as more pet owners prioritize health screenings and diagnostic tests. This growing awareness is expected to contribute to a steady increase in the number of tests conducted annually, further propelling market growth.

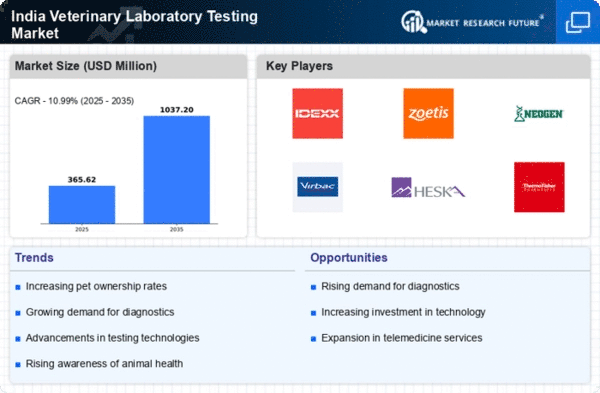

Advancements in Diagnostic Technologies

Technological innovations are significantly influencing the veterinary laboratory-testing market in India. The introduction of advanced diagnostic tools, such as molecular diagnostics and point-of-care testing, enhances the accuracy and speed of disease detection in animals. These technologies allow veterinarians to conduct tests that were previously unavailable or too complex. For instance, the use of polymerase chain reaction (PCR) tests has become more prevalent, enabling rapid identification of infectious diseases. The market for veterinary diagnostics is projected to grow at a CAGR of around 10% over the next five years, driven by these advancements. As a result, veterinary laboratories are increasingly adopting these technologies to improve service delivery and meet the rising expectations of pet owners.

Regulatory Support for Veterinary Practices

The veterinary laboratory-testing market in India is also being shaped by supportive regulatory frameworks that promote veterinary practices. The government has been implementing policies aimed at enhancing animal health standards and ensuring the availability of quality veterinary services. These regulations encourage veterinary clinics to adopt laboratory testing as a standard practice for diagnosing and managing animal health issues. Furthermore, initiatives to improve veterinary education and training are likely to lead to a more skilled workforce capable of utilizing advanced diagnostic tools. As regulatory support strengthens, the veterinary laboratory-testing market is expected to expand, providing better services to pet owners and improving overall animal health outcomes.