Rising Geriatric Population

The demographic shift towards an aging population in India is a significant driver for the vascular embolization market. By 2025, it is projected that approximately 10% of India's population will be aged 60 and above, leading to an increased prevalence of vascular diseases. Older adults are more susceptible to conditions such as aneurysms and varicose veins, which often require embolization procedures. This demographic trend necessitates the expansion of healthcare services tailored to the needs of the elderly, thereby boosting the demand for vascular embolization treatments. Additionally, the healthcare system is likely to adapt by enhancing its capabilities to address the specific challenges associated with treating older patients, further propelling the growth of the vascular embolization market.

Supportive Regulatory Framework

A supportive regulatory framework in India is emerging as a crucial driver for the vascular embolization market. The government is actively working to streamline the approval processes for medical devices and procedures, which encourages innovation and market entry for new technologies. Regulatory bodies are increasingly focusing on ensuring patient safety while also promoting the adoption of advanced medical solutions. As of 2025, it is expected that the time taken for regulatory approvals will decrease by around 15%, facilitating quicker access to new embolization products. This proactive approach not only enhances the competitiveness of the vascular embolization market but also ensures that patients benefit from the latest advancements in treatment options.

Increasing Healthcare Expenditure

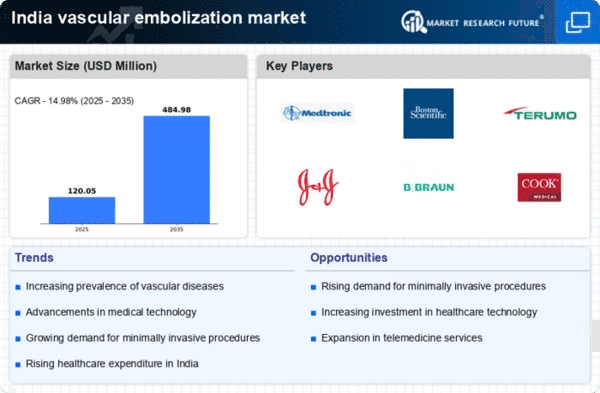

The rising healthcare expenditure in India is a pivotal driver for the vascular embolization market. As the government and private sectors allocate more funds towards healthcare, the availability of advanced medical technologies increases. In 2025, healthcare spending in India is projected to reach approximately $370 billion, reflecting a growth rate of around 12% annually. This financial commitment facilitates the adoption of innovative embolization techniques and devices, enhancing treatment options for patients with vascular conditions. Furthermore, increased healthcare budgets allow for better training of medical professionals, ensuring that they are equipped to utilize these advanced technologies effectively. Consequently, the vascular embolization market benefits from a more robust healthcare infrastructure, which is essential for the successful implementation of these procedures.

Advancements in Imaging Technologies

The vascular embolization market is experiencing growth due to advancements in imaging technologies that enhance procedural accuracy and patient outcomes. Innovations such as 3D imaging and real-time imaging techniques are becoming increasingly integrated into embolization procedures. These technologies allow for better visualization of vascular structures, which is crucial for successful interventions. In 2025, it is anticipated that the adoption of advanced imaging modalities will increase by approximately 25%, as healthcare facilities recognize their importance in improving procedural efficacy. Enhanced imaging capabilities not only facilitate more precise embolization but also reduce the likelihood of complications, thereby fostering greater confidence among healthcare providers and patients alike. This trend is likely to drive further investment in the vascular embolization market.

Growing Awareness of Minimally Invasive Procedures

There is a notable increase in awareness regarding minimally invasive procedures among both healthcare providers and patients in India. This trend is significantly influencing the vascular embolization market, as patients increasingly prefer treatments that offer reduced recovery times and lower risks of complications. Educational campaigns and improved access to information have contributed to this shift in patient preferences. As of 2025, it is estimated that around 60% of patients are opting for minimally invasive options when available. This growing awareness not only drives demand for vascular embolization procedures but also encourages healthcare providers to invest in the necessary technologies and training. The result is a more competitive market landscape, where innovation and patient-centric approaches are prioritized.