Growing Awareness and Education

There is a notable increase in awareness and education regarding urinary health in India, which serves as a catalyst for the urinary catheters market. Campaigns aimed at educating the public about urinary disorders and the importance of timely intervention are gaining traction. Healthcare professionals are also emphasizing the need for proper catheter care and management, which is likely to lead to higher adoption rates of urinary catheters. As patients become more informed about their options, the demand for quality catheters is expected to rise. This shift towards proactive health management is anticipated to positively influence the urinary catheters market, as more individuals seek effective solutions for their urinary health needs.

Increased Healthcare Expenditure

India's healthcare expenditure has been on the rise, which positively influences the urinary catheters market. The government has been increasing its budget allocation for healthcare, aiming to enhance medical facilities and access to treatments. In 2025, healthcare spending is projected to reach approximately 3.5% of GDP, reflecting a growing commitment to improving health services. This increase in funding allows for better procurement of medical supplies, including urinary catheters, and enhances the overall quality of care. Additionally, as more hospitals and clinics upgrade their facilities, the demand for advanced urinary catheter solutions is likely to grow, further driving the market. The focus on patient-centered care and improved healthcare infrastructure is expected to bolster the urinary catheters market in the coming years.

Expansion of Healthcare Facilities

The expansion of healthcare facilities across India is a crucial driver for the urinary catheters market. With the establishment of new hospitals, clinics, and specialized care centers, access to medical services is improving, particularly in rural and semi-urban areas. This expansion is accompanied by an increased demand for various medical supplies, including urinary catheters. As healthcare infrastructure develops, the availability of trained medical personnel and resources for catheterization procedures is also likely to improve. Consequently, this growth in healthcare facilities is expected to enhance the overall market for urinary catheters, as more patients receive appropriate care and treatment for urinary conditions.

Rising Incidence of Urinary Disorders

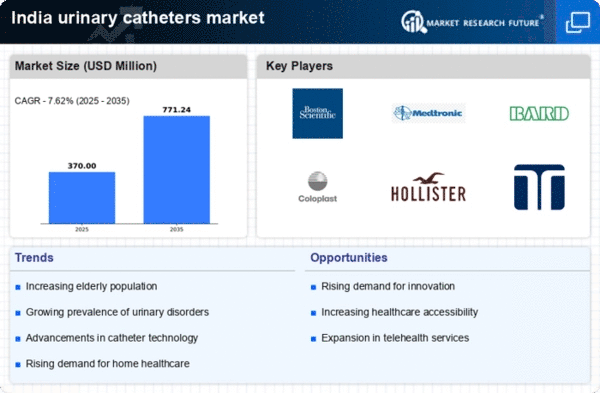

The increasing prevalence of urinary disorders in India is a primary driver for the urinary catheters market. Conditions such as urinary incontinence, benign prostatic hyperplasia, and urinary tract infections are becoming more common, particularly among the aging population. According to recent health statistics, approximately 30% of the elderly population in India experiences some form of urinary dysfunction. This growing patient base necessitates the use of urinary catheters, thereby propelling market growth. Furthermore, the rising awareness regarding treatment options and the importance of managing urinary health is likely to contribute to the demand for catheters. As healthcare providers focus on improving patient outcomes, the urinary catheters market is expected to expand significantly in response to these trends.

Technological Innovations in Catheter Design

Technological advancements in catheter design are significantly impacting the urinary catheters market. Innovations such as antimicrobial coatings, hydrophilic catheters, and advanced materials are enhancing the safety and comfort of catheterization. These developments aim to reduce the risk of infections and improve patient compliance. For instance, the introduction of self-lubricating catheters has been shown to decrease friction and discomfort during insertion. As healthcare providers increasingly adopt these advanced products, the urinary catheters market is likely to experience substantial growth. Furthermore, the integration of smart technologies, such as sensors for monitoring urinary output, may also emerge as a trend, potentially revolutionizing patient care and management in the urinary catheters market.