Increasing Power Outages

The frequency of power outages in India has been on the rise, driven by factors such as aging infrastructure and increased energy demand. This trend has led to a growing reliance on uninterruptible power supply (UPS) systems, which are essential for maintaining operations in both residential and commercial sectors. The ups battery market is experiencing heightened demand as businesses and households seek reliable backup solutions to mitigate the impact of power disruptions. According to recent data, the ups battery market in India is projected to grow at a CAGR of approximately 10% over the next five years, reflecting the urgent need for dependable power solutions. As organizations increasingly prioritize operational continuity, the ups battery market is likely to see sustained growth, driven by the necessity for uninterrupted power supply during outages.

Rising Consumer Awareness

Consumer awareness regarding the importance of power backup solutions is on the rise in India. As individuals and businesses become more informed about the risks associated with power outages, the demand for UPS systems is expected to increase. The ups battery market is benefiting from this heightened awareness, as consumers seek reliable and efficient power solutions to protect their electronic devices and critical operations. Educational campaigns and marketing efforts by UPS manufacturers are playing a crucial role in informing potential customers about the advantages of investing in quality UPS systems. This trend is likely to drive market growth, with estimates suggesting a potential increase in sales by 15% over the next few years. The growing emphasis on power reliability is reshaping consumer preferences within the ups battery market.

Expansion of IT Infrastructure

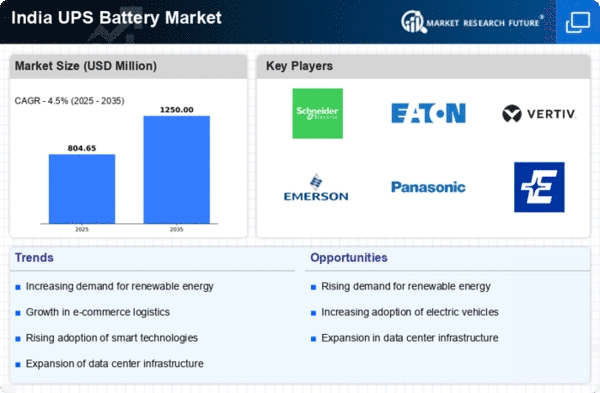

India's rapid digital transformation is significantly impacting the ups battery market. With the expansion of IT infrastructure, including data centers and cloud computing services, the demand for reliable power backup systems has surged. Businesses are increasingly investing in UPS systems to ensure the continuous operation of critical IT equipment. The ups battery market is projected to benefit from this trend, as organizations recognize the importance of maintaining uptime in a competitive landscape. Recent estimates suggest that the IT sector's growth could contribute to a substantial increase in UPS battery sales, with projections indicating a potential market size of $1 billion by 2026. This expansion underscores the critical role of UPS systems in supporting India's evolving technological landscape.

Government Initiatives for Renewable Energy

The Indian government's commitment to promoting renewable energy sources is influencing the ups battery market. As the country aims to achieve its renewable energy targets, there is a growing need for energy storage solutions that can support solar and wind power generation. UPS systems equipped with advanced battery technologies are becoming essential for integrating renewable energy into the grid. The ups battery market is likely to see increased demand as businesses and households adopt solar power systems, necessitating reliable backup solutions. Government incentives and subsidies for renewable energy projects further enhance the attractiveness of UPS systems, potentially leading to a market growth rate of 12% over the next few years. This trend highlights the intersection of sustainability and technology within the ups battery market.

Technological Innovations in Battery Technology

Advancements in battery technology are significantly impacting the ups battery market in India. Innovations such as lithium-ion batteries and smart UPS systems are enhancing the efficiency and performance of power backup solutions. These technological improvements are attracting both residential and commercial customers, as they offer longer life cycles, faster charging times, and reduced maintenance costs. The ups battery market is poised for growth as manufacturers continue to invest in research and development to create more efficient and sustainable battery solutions. Recent reports indicate that the adoption of advanced battery technologies could lead to a market expansion of approximately 20% by 2027. This trend underscores the importance of innovation in driving the evolution of the ups battery market.