Government Initiatives

Government initiatives aimed at enhancing traveler safety are playing a crucial role in shaping the traveler security-services market in India. The Ministry of Tourism has launched various programs to promote safe travel, which includes collaborations with security agencies. These initiatives are designed to bolster the confidence of travelers, thereby increasing the demand for security services. For instance, the introduction of safety protocols and guidelines for hotels and transport services has led to a heightened awareness of security needs. As a result, The traveler security services market is likely to see a significant uptick in service adoption. This is because both domestic and international travelers prioritize safety.

Rising Travel Activity

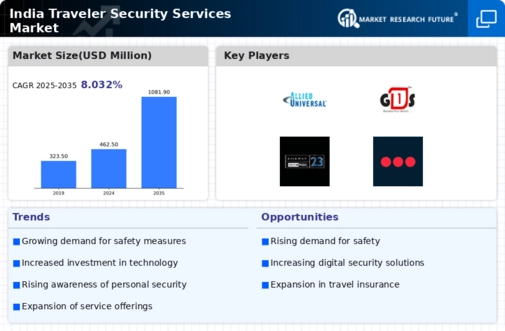

The traveler security-services market in India is experiencing growth due to an increase in travel activity. As domestic and international travel resumes, the demand for security services is likely to rise. In 2025, the Indian tourism sector is projected to contribute approximately $250 billion to the economy, indicating a robust recovery. This surge in travel necessitates enhanced security measures to protect travelers from potential threats. Consequently, security service providers are adapting their offerings to meet the needs of a diverse clientele, including business travelers and tourists. the traveler security services market is thus positioned to benefit from this upward trend, as individuals seek assurance during their journeys.

Increase in Risk Perception

The increase in risk perception among travelers is a significant driver for the traveler security-services market in India. Recent studies indicate that travelers are more aware of potential threats, including theft, fraud, and natural disasters. This heightened awareness is leading to a greater demand for security services that can mitigate these risks. As a result, security providers are expanding their service offerings to include risk assessment and management solutions. the traveler security services market is thus likely to see a shift towards more proactive security measures, as travelers seek to ensure their safety during their journeys.

Growing Awareness of Personal Safety

There is a noticeable increase in awareness regarding personal safety among travelers in India, which is influencing the traveler security-services market. As individuals become more conscious of potential risks associated with travel, they are more inclined to invest in security services. Surveys indicate that approximately 70% of travelers consider personal safety a top priority when planning trips. This growing awareness is prompting security service providers to tailor their offerings, ensuring they address specific concerns of travelers. The traveler security-services market is thus evolving to meet these demands, potentially leading to innovative solutions that enhance traveler safety.

Technological Advancements in Security

Technological advancements are significantly impacting the traveler security-services market in India. The integration of cutting-edge technologies such as artificial intelligence, biometric systems, and mobile applications is enhancing the efficiency and effectiveness of security services. For instance, the use of AI-driven surveillance systems can provide real-time monitoring, which is increasingly appealing to travelers. As technology continues to evolve, security service providers are likely to adopt these innovations to offer more comprehensive solutions. This trend suggests that the traveler security-services market will not only grow but also become more sophisticated, catering to the evolving needs of modern travelers.