Increasing Cyber Threats

The escalation of cyber threats in India is a primary driver for the threat intelligence market. With the rise in sophisticated cyber attacks, organizations are compelled to invest in threat intelligence solutions to safeguard their digital assets. Reports indicate that cybercrime costs in India could reach $13 billion by 2025, highlighting the urgency for enhanced security measures. is expected to grow as businesses recognize the necessity of proactive threat detection and response strategies.. This trend is further fueled by the increasing number of data breaches and ransomware incidents, which have prompted organizations to seek comprehensive threat intelligence services. As a result, the demand for threat intelligence solutions is likely to surge, positioning the market for substantial growth in the coming years.

Growth of Digital Transformation

The rapid pace of digital transformation across various sectors in India is a significant driver for the threat intelligence market. As organizations increasingly adopt cloud computing, IoT, and mobile technologies, the attack surface for cyber threats expands. This transformation necessitates the integration of advanced threat intelligence solutions to identify and mitigate potential risks. The market is projected to grow as businesses recognize the importance of securing their digital infrastructures. According to industry estimates, the digital transformation market in India is expected to reach $1 trillion by 2025, further emphasizing the need for effective threat intelligence strategies. Consequently, organizations are likely to invest in threat intelligence services to enhance their cybersecurity posture amidst this digital evolution.

Regulatory Compliance Requirements

The evolving regulatory landscape in India significantly influences the threat intelligence market. Organizations are increasingly required to comply with stringent data protection regulations, such as the Information Technology Act and the proposed Personal Data Protection Bill. These regulations necessitate the implementation of robust cybersecurity measures, including threat intelligence solutions, to ensure compliance and protect sensitive data. Failure to adhere to these regulations can result in hefty fines and reputational damage, prompting businesses to prioritize threat intelligence investments. The market is likely to expand as companies seek to align their security practices with regulatory requirements, thereby driving the adoption of threat intelligence services. This compliance-driven demand is expected to shape the future of the threat intelligence market in India.

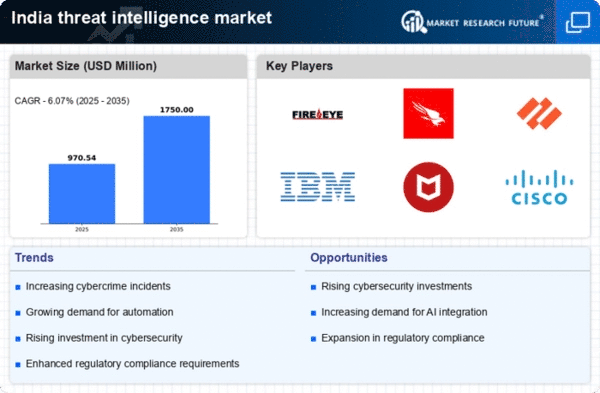

Rising Investment in Cybersecurity

The increasing allocation of resources towards cybersecurity in India is a crucial driver for the threat intelligence market. Organizations are recognizing the importance of safeguarding their information assets and are thus increasing their cybersecurity budgets. In 2025, it is anticipated that Indian companies will spend approximately $3.5 billion on cybersecurity solutions, which includes threat intelligence services. This growing investment reflects a shift in organizational priorities towards proactive security measures. As businesses seek to protect themselves from evolving cyber threats, the demand for threat intelligence solutions is expected to rise. This trend indicates a robust growth trajectory for the threat intelligence market, as organizations strive to enhance their security frameworks and mitigate potential risks.

Collaboration Among Security Providers

The trend of collaboration among cybersecurity providers in India is emerging as a significant driver for the threat intelligence market. Partnerships and alliances between technology firms, government agencies, and cybersecurity experts are fostering the sharing of threat intelligence data and best practices. This collaborative approach enhances the overall effectiveness of threat intelligence solutions, enabling organizations to respond more swiftly to emerging threats. As the threat landscape becomes increasingly complex, the need for shared intelligence is paramount. The threat intelligence market is likely to benefit from this trend, as organizations seek comprehensive solutions that leverage collective insights. This collaborative environment is expected to drive innovation and improve the overall resilience of the cybersecurity ecosystem in India.