Growth of Surgical Procedures

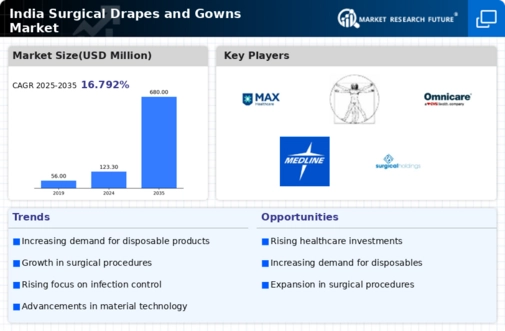

The India Surgical Drapes And Gowns Market is benefiting from the increasing number of surgical procedures performed across the country. With advancements in medical technology and an increase in the prevalence of chronic diseases, the volume of surgeries is on the rise. According to recent estimates, the number of surgeries in India is expected to grow by approximately 10% annually. This surge in surgical activity necessitates a corresponding increase in the use of surgical drapes and gowns, as they are essential for maintaining sterile environments during operations. Consequently, this trend is likely to bolster the market for surgical textiles.

Increasing Healthcare Expenditure

The India Surgical Drapes And Gowns Market is experiencing growth due to the rising healthcare expenditure in the country. The government has been increasing its budget allocation for healthcare, which is projected to reach approximately 2.5% of GDP by 2025. This increase in funding is likely to enhance the infrastructure of hospitals and clinics, leading to a higher demand for surgical drapes and gowns. Furthermore, private healthcare providers are also expanding their services, which may contribute to the overall market growth. As more healthcare facilities emerge, the need for high-quality surgical drapes and gowns becomes paramount, thereby driving the market forward.

Regulatory Compliance and Standards

The India Surgical Drapes And Gowns Market is influenced by stringent regulatory compliance and standards set by health authorities. The Bureau of Indian Standards (BIS) has established guidelines for the manufacturing and quality of surgical textiles. Compliance with these regulations ensures that products meet safety and efficacy standards, which is crucial for healthcare providers. As hospitals and surgical centers prioritize patient safety, the demand for compliant surgical drapes and gowns is likely to increase. This regulatory environment not only fosters trust among healthcare professionals but also encourages manufacturers to innovate and improve their product offerings.

Emergence of E-commerce in Healthcare

The India Surgical Drapes And Gowns Market is witnessing a transformation due to the emergence of e-commerce platforms in the healthcare sector. Online marketplaces are making it easier for healthcare providers to access a wide range of surgical drapes and gowns, often at competitive prices. This shift towards digital procurement is likely to enhance market accessibility and convenience for hospitals and clinics, particularly in rural areas where traditional supply chains may be less developed. As e-commerce continues to grow, it may facilitate the entry of new players into the market, thereby increasing competition and potentially driving innovation in product offerings.

Rising Awareness of Infection Control

The India Surgical Drapes And Gowns Market is significantly impacted by the growing awareness of infection control among healthcare professionals. Hospitals are increasingly adopting stringent infection prevention protocols to minimize the risk of hospital-acquired infections (HAIs). This heightened focus on infection control is driving the demand for high-quality surgical drapes and gowns that provide effective barriers against pathogens. As healthcare facilities prioritize patient safety and quality of care, the market for surgical textiles is expected to expand. This trend may lead to innovations in materials and designs that enhance the protective capabilities of surgical drapes and gowns.