Regulatory Framework Enhancements

The evolving regulatory landscape in India is significantly impacting the subscriber data-management market. With the introduction of stringent data protection laws, organizations are compelled to adopt robust data management practices to ensure compliance. The Personal Data Protection Bill, which is expected to be enacted soon, mandates that companies implement comprehensive data governance frameworks. This regulatory shift is likely to increase the demand for sophisticated data management solutions, as businesses seek to mitigate risks associated with non-compliance. Consequently, the subscriber data-management market is poised for growth as organizations invest in technologies that facilitate adherence to these regulations.

Increasing Demand for Personalization

The subscriber data-management market is experiencing a notable surge in demand for personalized services. As businesses strive to enhance customer engagement, they are increasingly leveraging data analytics to tailor offerings to individual preferences. This trend is particularly pronounced in sectors such as telecommunications and e-commerce, where companies are utilizing subscriber data to create targeted marketing campaigns. According to recent estimates, the market for personalized marketing in India is projected to grow at a CAGR of 25% over the next five years. This growing emphasis on personalization is driving investments in advanced data management solutions, thereby propelling the subscriber data-management market forward.

Rising Adoption of Mobile Technologies

The proliferation of mobile technologies is significantly influencing the subscriber data-management market. With the increasing penetration of smartphones and mobile internet, businesses are collecting vast amounts of subscriber data through mobile applications. This trend is particularly evident in sectors like banking and entertainment, where mobile platforms serve as primary channels for customer interaction. As mobile data usage continues to rise, organizations are compelled to invest in data management solutions that can effectively handle and analyze this influx of information. Consequently, the subscriber data-management market is expected to witness substantial growth as companies seek to optimize their mobile data strategies.

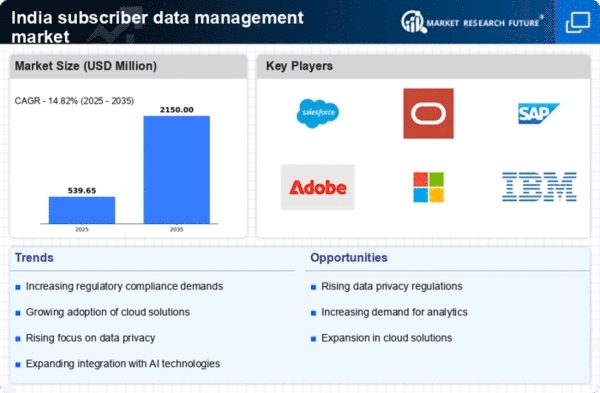

Shift Towards Cloud-Based Data Solutions

The shift towards cloud-based data solutions is transforming the subscriber data-management market. Organizations in India are increasingly migrating their data management processes to the cloud, driven by the need for scalability, flexibility, and cost-effectiveness. This transition allows businesses to access real-time data insights and enhances collaboration across departments. According to market forecasts, the cloud computing market in India is anticipated to reach $10 billion by 2025, indicating a robust trend towards cloud adoption. As more companies embrace cloud technologies, the demand for effective subscriber data management solutions is likely to escalate, further propelling market growth.

Technological Advancements in Data Analytics

Technological advancements in data analytics are reshaping the subscriber data-management market. The integration of machine learning and artificial intelligence into data management systems is enabling organizations to derive actionable insights from vast amounts of subscriber data. This capability is particularly crucial for industries such as finance and retail, where understanding customer behavior can lead to improved service delivery. As per industry reports, the adoption of AI-driven analytics tools is expected to increase by 40% in the next three years, indicating a strong trend towards data-driven decision-making. Such advancements are likely to enhance the efficiency and effectiveness of subscriber data management.