Growth in HVAC Applications

The solenoid valve market is witnessing significant growth in the heating, ventilation, and air conditioning (HVAC) sector in India. This growth is driven by the rising demand for energy-efficient systems and the increasing focus on climate control. With the rising demand for energy-efficient systems and the increasing focus on climate control, solenoid valves are becoming integral to modern HVAC systems. These valves play a crucial role in regulating refrigerant flow and maintaining optimal temperatures. The Indian HVAC market is anticipated to reach a valuation of $10 billion by 2026, growing at a CAGR of around 15%. This growth is likely to propel the solenoid valve market, as manufacturers seek reliable and efficient solutions to meet the evolving needs of consumers. The integration of smart technologies in HVAC systems further emphasizes the importance of solenoid valves in ensuring seamless operation and energy efficiency.

Rising Industrial Automation

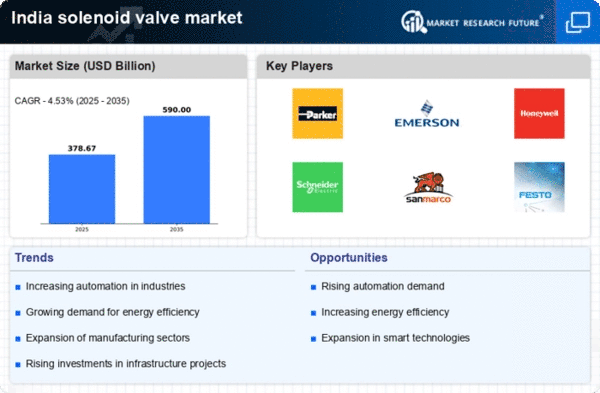

The solenoid valve market in India is experiencing a notable surge due to the increasing adoption of industrial automation across various sectors. Industries such as manufacturing, oil and gas, and water treatment are integrating automated systems to enhance efficiency and reduce operational costs. This trend is expected to drive the demand for solenoid valves, which are essential components in controlling fluid flow in automated systems. According to recent estimates, the automation market in India is projected to grow at a CAGR of approximately 10% over the next five years, thereby positively impacting the solenoid valve market. As industries seek to optimize processes, the reliance on solenoid valves for precise control mechanisms is likely to increase, further solidifying their role in the industrial landscape.

Emergence of Smart Technologies

The solenoid valve market is poised for growth. This growth is attributed to the emergence of smart technologies in various applications. The integration of IoT and automation in industrial processes is transforming how solenoid valves are utilized. Smart solenoid valves equipped with sensors and connectivity features allow for real-time monitoring and control, enhancing operational efficiency. This trend is particularly relevant in sectors such as manufacturing and energy, where precise control over fluid dynamics is crucial. The Indian market for smart technologies is projected to grow significantly, potentially reaching $5 billion by 2027. As industries increasingly adopt smart solutions, the demand for advanced solenoid valves that can seamlessly integrate with these technologies is likely to rise, further propelling the solenoid valve market.

Increased Focus on Safety Standards

The solenoid valve market in India is also driven by an increased focus on safety standards across various industries. As regulatory bodies enforce stricter safety regulations, industries are compelled to adopt advanced safety measures. As regulatory bodies enforce stricter safety regulations, industries are compelled to adopt advanced safety measures, including the use of solenoid valves. These valves are critical in applications where safety and reliability are paramount, such as in chemical processing and oil and gas sectors. The implementation of safety standards is expected to create a robust demand for solenoid valves, as companies seek to comply with regulations and ensure operational safety. The market is likely to benefit from this trend, as industries prioritize the integration of reliable components that meet safety requirements, thereby enhancing the overall safety profile of their operations.

Expansion of Water Management Systems

The solenoid valve market is significantly influenced by the expansion of water management systems in India. As urbanization accelerates, the demand for efficient water distribution and management systems is on the rise. As urbanization accelerates, the demand for efficient water distribution and management systems is on the rise. Solenoid valves are essential in controlling water flow in various applications, including irrigation, municipal water supply, and wastewater treatment. The Indian government has initiated several projects aimed at improving water infrastructure, which is expected to boost the solenoid valve market. With an estimated investment of $20 billion in water management projects over the next five years, the market for solenoid valves is likely to see substantial growth. This trend indicates a shift towards more automated and efficient water management solutions, where solenoid valves play a pivotal role.