Rising Cybersecurity Threats

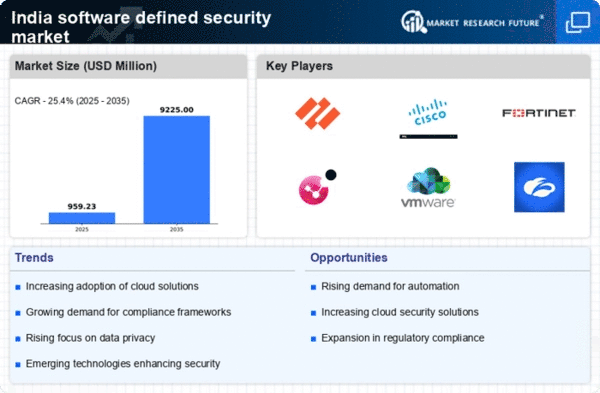

The software defined-security market in India is experiencing a surge due to the increasing frequency and sophistication of cyber threats. Organizations are compelled to adopt advanced security measures to protect sensitive data and maintain operational integrity. In 2025, it is estimated that cybercrime could cost businesses globally over $10 trillion annually, prompting Indian enterprises to invest heavily in software defined-security solutions. This market is projected to grow at a CAGR of 25% from 2025 to 2030, driven by the urgent need for robust security frameworks. As cyber threats evolve, the software defined-security market is likely to expand, offering innovative solutions that address these challenges effectively.

Growing Awareness of Data Privacy

There is a rising awareness of data privacy among Indian consumers and businesses, which is driving the software defined-security market. With increasing incidents of data breaches and privacy violations, organizations are prioritizing the protection of personal and sensitive information. The implementation of data protection regulations is compelling businesses to adopt software defined-security solutions that ensure compliance and enhance data security. The market is anticipated to grow at a rate of 22% as companies recognize the importance of safeguarding customer data and maintaining trust. This heightened focus on data privacy is likely to propel the software defined-security market forward, as organizations seek to implement comprehensive security frameworks.

Increased Adoption of Remote Work

The shift towards remote work in India has significantly influenced the software defined-security market. As organizations embrace flexible work arrangements, the need for secure access to corporate resources has intensified. This trend has led to a greater reliance on software defined-security solutions that can provide secure connectivity and protect against potential vulnerabilities. In 2025, it is projected that remote work will account for over 30% of the workforce in India, necessitating robust security measures. Consequently, the software defined-security market is likely to see a substantial increase in demand as companies seek to safeguard their digital assets in a remote work environment.

Government Initiatives and Regulations

The Indian government is actively promoting digital transformation, which has a direct impact on the software defined-security market. Initiatives such as Digital India and the National Cyber Security Policy aim to enhance the country's cybersecurity posture. Compliance with regulations like the Information Technology Act and data protection laws is becoming increasingly stringent. As a result, organizations are investing in software defined-security solutions to ensure compliance and mitigate risks. The market is expected to witness a growth rate of approximately 20% in the coming years, as businesses align their security strategies with government mandates and regulations, thereby driving demand for advanced security technologies.

Technological Advancements in Security Solutions

Technological advancements are playing a crucial role in shaping the software defined-security market in India. Innovations such as artificial intelligence, machine learning, and advanced analytics are enhancing the capabilities of security solutions. These technologies enable organizations to detect threats in real-time and respond proactively, thereby improving overall security posture. As businesses increasingly adopt these advanced technologies, the software defined-security market is expected to grow significantly. In 2025, the market is projected to expand by 30%, driven by the demand for cutting-edge security solutions that can address the complexities of modern cyber threats. This trend indicates a shift towards more intelligent and adaptive security measures.