Emergence of Edge Computing

The rise of edge computing is significantly influencing the software defined-data-center market in India. As organizations seek to process data closer to the source, the demand for decentralized computing solutions is increasing. This trend is particularly relevant for industries such as manufacturing and healthcare, where real-time data processing is crucial. The integration of edge computing with software defined-data-center technologies allows for enhanced performance and reduced latency. Analysts predict that the edge computing market will grow substantially, potentially reaching a valuation of $15 billion by 2026. This convergence of technologies is likely to reshape the landscape of the software defined-data-center market, driving innovation and new use cases.

Rising Demand for Scalability

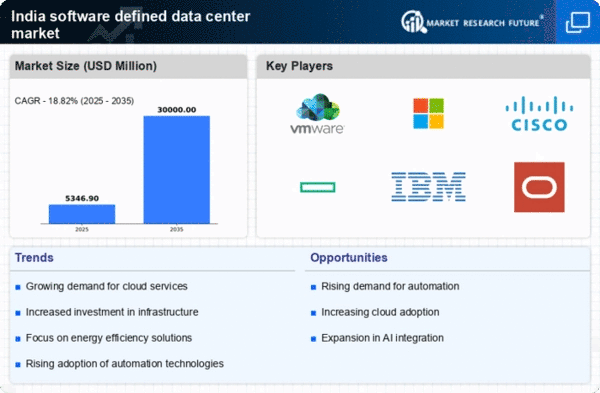

The software defined-data-center market in India experiences a notable surge in demand for scalability solutions. As businesses expand, they require flexible infrastructure that can adapt to changing workloads. This demand is driven by the need for efficient resource allocation and the ability to scale operations without significant capital expenditure. According to recent estimates, the market is projected to grow at a CAGR of approximately 25% over the next five years. Companies are increasingly adopting software defined-data-center solutions to enhance their operational efficiency and reduce time-to-market for new applications. This trend indicates a shift towards more agile IT environments, where scalability is paramount for maintaining competitive advantage.

Growing Importance of Data Security

Data security has emerged as a paramount concern for organizations in the software defined-data-center market in India. With the increasing frequency of cyber threats, businesses are prioritizing robust security measures to protect sensitive information. The software defined-data-center model offers advanced security features, such as automated threat detection and response capabilities, which are essential for safeguarding data. As per industry insights, nearly 70% of organizations consider security a top priority when implementing new IT solutions. This heightened focus on security is likely to drive the adoption of software defined-data-center technologies, as companies seek to mitigate risks and ensure compliance with regulatory standards.

Increased Focus on Cost Optimization

Cost optimization remains a critical driver for the software defined-data-center market in India. Organizations are under constant pressure to reduce operational costs while maintaining high service levels. By leveraging software defined-data-center technologies, companies can achieve significant savings through improved resource utilization and reduced hardware dependency. Reports suggest that businesses can save up to 30% on IT costs by transitioning to a software defined-data-center model. This financial incentive encourages more enterprises to explore these solutions, as they seek to streamline their IT expenditures and enhance overall profitability. The emphasis on cost efficiency is likely to propel further adoption of software defined-data-center technologies across various sectors.

Regulatory Compliance and Data Sovereignty

Regulatory compliance is a significant driver for the software defined-data-center market in India. With the introduction of stringent data protection laws, organizations are compelled to adopt solutions that ensure compliance with local regulations. The software defined-data-center model facilitates better data management and governance, enabling businesses to adhere to legal requirements regarding data sovereignty. As companies navigate the complexities of compliance, the demand for software defined-data-center technologies is expected to rise. This trend is particularly relevant in sectors such as finance and healthcare, where data privacy is critical. The focus on regulatory compliance is likely to propel the growth of the software defined-data-center market as organizations seek to mitigate legal risks.