Rise of Social Media Platforms

The proliferation of social media platforms in India serves as a crucial driver for the social business intelligence market. With over 500 million active social media users, businesses are increasingly turning to social analytics to understand consumer sentiments and preferences. This trend is evident as companies utilize social listening tools to gather insights from platforms like Facebook, Twitter, and Instagram. The ability to analyze social media data allows organizations to tailor their marketing strategies and enhance customer engagement. As social media continues to evolve, the demand for sophisticated social business intelligence solutions is likely to rise, enabling businesses to stay attuned to market trends and consumer behavior.

Government Initiatives and Support

Government initiatives aimed at promoting digital transformation and data analytics are significantly influencing the India social business intelligence market. The Digital India program, launched to enhance digital infrastructure, has created a conducive environment for businesses to adopt advanced analytics solutions. Furthermore, the government's push for smart cities and e-governance initiatives has led to increased investments in data analytics capabilities. These initiatives not only facilitate the growth of social business intelligence tools but also encourage public-private partnerships, fostering innovation in data utilization. As a result, businesses are more inclined to invest in social business intelligence solutions to align with government policies and leverage available resources.

Focus on Customer Experience Enhancement

The growing focus on enhancing customer experience is a significant driver in the India social business intelligence market. Companies are increasingly recognizing that understanding customer preferences and behaviors is essential for fostering loyalty and retention. Social business intelligence tools provide valuable insights into customer interactions and feedback, enabling organizations to tailor their offerings accordingly. As businesses strive to create personalized experiences, the demand for social analytics solutions is likely to increase. This trend is supported by the fact that organizations that prioritize customer experience are more likely to achieve higher revenue growth. Therefore, investing in social business intelligence tools becomes imperative for companies aiming to enhance their customer engagement strategies.

Emergence of Advanced Analytics Technologies

The emergence of advanced analytics technologies, including artificial intelligence and machine learning, is reshaping the landscape of the India social business intelligence market. These technologies enable organizations to process vast amounts of data efficiently, uncovering hidden patterns and trends that inform strategic decisions. As businesses increasingly adopt these technologies, the demand for social business intelligence tools that incorporate AI-driven analytics is expected to surge. This shift not only enhances the accuracy of insights but also allows for predictive modeling, enabling companies to anticipate market changes. Consequently, organizations are likely to invest in advanced social business intelligence solutions to gain a competitive edge in their respective industries.

Growing Demand for Data-Driven Decision Making

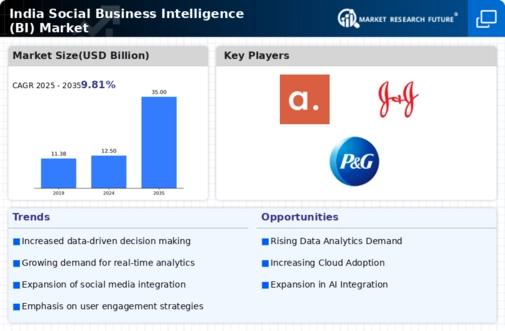

The increasing emphasis on data-driven decision making is a pivotal driver in the India social business intelligence market. Organizations across various sectors are recognizing the necessity of leveraging data analytics to enhance operational efficiency and customer engagement. According to recent reports, the market for business intelligence tools in India is projected to grow at a compound annual growth rate of approximately 25% over the next five years. This growth is fueled by the need for real-time insights and predictive analytics, enabling businesses to make informed decisions swiftly. As companies strive to remain competitive, the integration of social business intelligence tools becomes essential, allowing them to harness social media data and consumer behavior insights effectively.