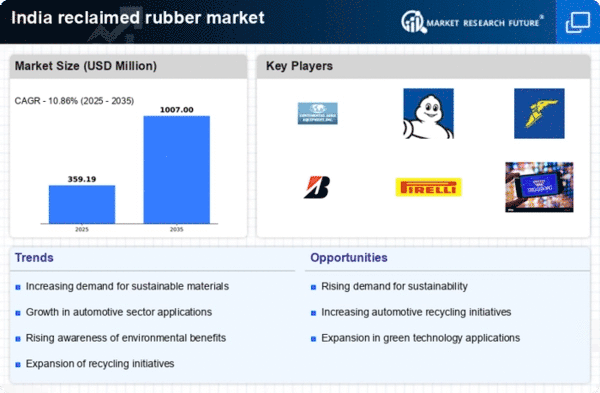

The reclaimed rubber market in India is characterized by a competitive landscape that is increasingly shaped by sustainability initiatives and technological advancements. Key players are actively pursuing strategies that emphasize innovation, regional expansion, and partnerships to enhance their market positioning. Companies such as Continental AG (Germany), Michelin (France), and Goodyear Tire & Rubber Company (US) are at the forefront, leveraging their global expertise to tap into the growing demand for eco-friendly materials. Their collective focus on sustainable practices not only drives growth but also fosters a competitive environment that prioritizes environmental responsibility alongside profitability.In terms of business tactics, localizing manufacturing and optimizing supply chains appear to be critical strategies for success in this market. The competitive structure is moderately fragmented, with several players vying for market share. However, the influence of major companies is substantial, as they set benchmarks for quality and innovation. This dynamic encourages smaller firms to adapt and innovate, thereby enhancing the overall competitiveness of the reclaimed rubber sector in India.

In October Michelin (France) announced a strategic partnership with a local Indian firm to enhance its reclaimed rubber production capabilities. This collaboration is expected to streamline operations and reduce costs, thereby increasing the availability of sustainable rubber products in the region. Such partnerships are indicative of a broader trend where established companies seek to leverage local expertise to bolster their operational efficiency and market reach.

In September Goodyear Tire & Rubber Company (US) unveiled a new line of eco-friendly tires that incorporate reclaimed rubber, showcasing their commitment to sustainability. This product launch not only aligns with The reclaimed rubber market. The integration of reclaimed materials into their product offerings is likely to resonate well with environmentally conscious consumers, enhancing brand loyalty and market share.

In August Continental AG (Germany) expanded its research and development efforts in India, focusing on advanced recycling technologies for rubber. This initiative underscores the company's commitment to innovation and sustainability, as it aims to develop more efficient methods for reclaiming rubber. By investing in R&D, Continental is not only enhancing its product portfolio but also contributing to the overall advancement of the industry.

As of November the competitive trends in the reclaimed rubber market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in achieving their sustainability goals. Looking ahead, it is anticipated that competitive differentiation will evolve, shifting from traditional price-based competition to a focus on innovation, technological advancements, and supply chain reliability. This transition is likely to reshape the market dynamics, fostering a more sustainable and resilient industry.