Increased Focus on Regulatory Compliance

In the context of the product life-cycle-management market, the increasing emphasis on regulatory compliance is a significant driver. Indian industries are facing stringent regulations regarding product safety, quality, and environmental impact. As a result, companies are compelled to adopt comprehensive product life-cycle-management solutions that ensure adherence to these regulations. The market for compliance management software is expected to grow by approximately 15% annually. This reflects the urgency for businesses to integrate compliance into their product development processes. This trend not only mitigates risks associated with non-compliance but also enhances brand reputation, making it a critical factor in the evolution of the product life-cycle-management market.

Expansion of E-commerce and Online Retail

The rapid expansion of e-commerce and online retail in India is a pivotal driver for the product life-cycle-management market. With the increasing number of consumers turning to online platforms for their shopping needs, businesses are compelled to adapt their product strategies accordingly. This shift necessitates robust product life-cycle-management solutions that can handle the complexities of online sales, including inventory management, order fulfillment, and customer engagement. The e-commerce market in India is expected to reach $200 billion by 2026, underscoring the need for effective product life-cycle-management tools that support seamless integration between online and offline channels. This trend is likely to propel growth in the product life-cycle-management market as companies seek to enhance their operational efficiency and customer satisfaction.

Emphasis on Customer-Centric Product Development

In the product life-cycle-management market, there is a growing emphasis on customer-centric product development strategies. Companies are increasingly recognizing the importance of aligning their product offerings with customer preferences and market trends. This shift is prompting businesses to invest in product life-cycle-management solutions that facilitate customer feedback integration, market analysis, and agile development methodologies. As a result, organizations are better positioned to respond to changing consumer demands, which is crucial in a competitive landscape. The market for customer experience management tools is projected to grow by 20% annually, indicating a strong correlation between customer-centric approaches and the evolution of the product life-cycle-management market.

Rising Demand for Efficient Supply Chain Management

The product life-cycle-management market in India is experiencing a notable surge in demand for efficient supply chain management solutions. As businesses strive to optimize their operations, the need for integrated systems that streamline product development, manufacturing, and distribution becomes paramount. According to recent data, the Indian logistics sector is projected to grow at a CAGR of 10.5% from 2021 to 2026, indicating a robust market for solutions that enhance supply chain efficiency. This trend is likely to drive investments in product life-cycle-management tools that facilitate real-time tracking, inventory management, and demand forecasting, ultimately leading to reduced operational costs and improved customer satisfaction.

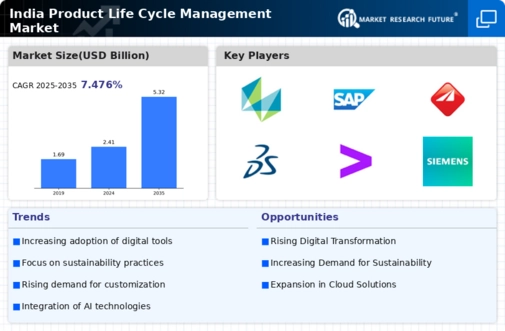

Growing Adoption of Digital Transformation Initiatives

The ongoing digital transformation across various sectors in India is significantly influencing the product life-cycle-management market. Organizations are increasingly leveraging digital technologies to enhance their product development processes, improve collaboration, and drive innovation. A report indicates that the digital transformation market in India is anticipated to reach $100 billion by 2025, highlighting the potential for product life-cycle-management solutions that incorporate advanced analytics, artificial intelligence, and cloud computing. This shift towards digitalization is likely to empower companies to make data-driven decisions, optimize resource allocation, and accelerate time-to-market, thereby fostering growth in the product life-cycle-management market.