Rising Disposable Income

The rise in disposable income among the Indian population is another significant driver for the pregnancy test-kits market. As economic conditions improve, more households have the financial capacity to invest in health-related products. This trend is particularly evident in urban areas, where disposable income has increased by around 15% over the past few years. Consequently, women are more inclined to purchase pregnancy test kits for personal use, leading to a surge in market demand. The affordability of these kits, combined with rising income levels, suggests a positive outlook for the pregnancy test-kits market.

Expansion of E-commerce Platforms

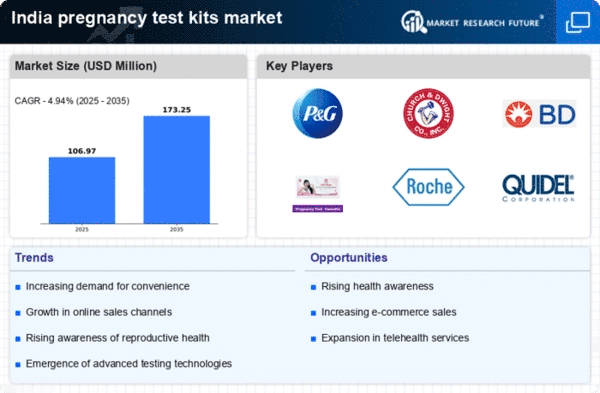

The expansion of e-commerce platforms in India is significantly impacting the pregnancy test-kits market. With the rise of online shopping, consumers have greater access to a variety of pregnancy test kits, often at competitive prices. E-commerce platforms provide convenience and privacy, which are essential factors for consumers purchasing such personal health products. Reports suggest that online sales of pregnancy test kits have increased by approximately 25% in recent years. This trend indicates a shift in consumer purchasing behavior, which is likely to continue driving the growth of the pregnancy test-kits market.

Technological Advancements in Testing

Technological advancements in the development of pregnancy test kits are transforming the landscape of the pregnancy test-kits market. Innovations such as digital displays, faster results, and higher sensitivity levels are appealing to consumers. The introduction of smartphone-compatible test kits is also gaining traction, allowing users to track their reproductive health more effectively. These advancements not only enhance user experience but also increase the accuracy of results, which is crucial for consumers. As technology continues to evolve, it is likely to further stimulate growth in the pregnancy test-kits market.

Cultural Shifts Towards Family Planning

Cultural shifts in India towards family planning and reproductive health are influencing the pregnancy test-kits market. With changing societal norms, more couples are opting for planned pregnancies, leading to an increased demand for pregnancy test kits. This trend is particularly pronounced among younger generations who prioritize family planning and reproductive health. Surveys indicate that around 70% of young couples are now considering pregnancy tests as a part of their family planning strategy. This cultural shift is expected to drive the growth of the pregnancy test-kits market as more individuals seek to monitor their reproductive health.

Growing Awareness of Reproductive Health

The increasing awareness of reproductive health among women in India is a pivotal driver for the pregnancy test-kits market. Educational initiatives and health campaigns have contributed to a heightened understanding of fertility and family planning. As women become more informed about their reproductive health, the demand for pregnancy test kits is likely to rise. Reports indicate that approximately 60% of women in urban areas are now aware of the various types of pregnancy tests available. This awareness not only encourages early detection of pregnancy but also promotes responsible family planning, thereby driving the growth of the pregnancy test-kits market.