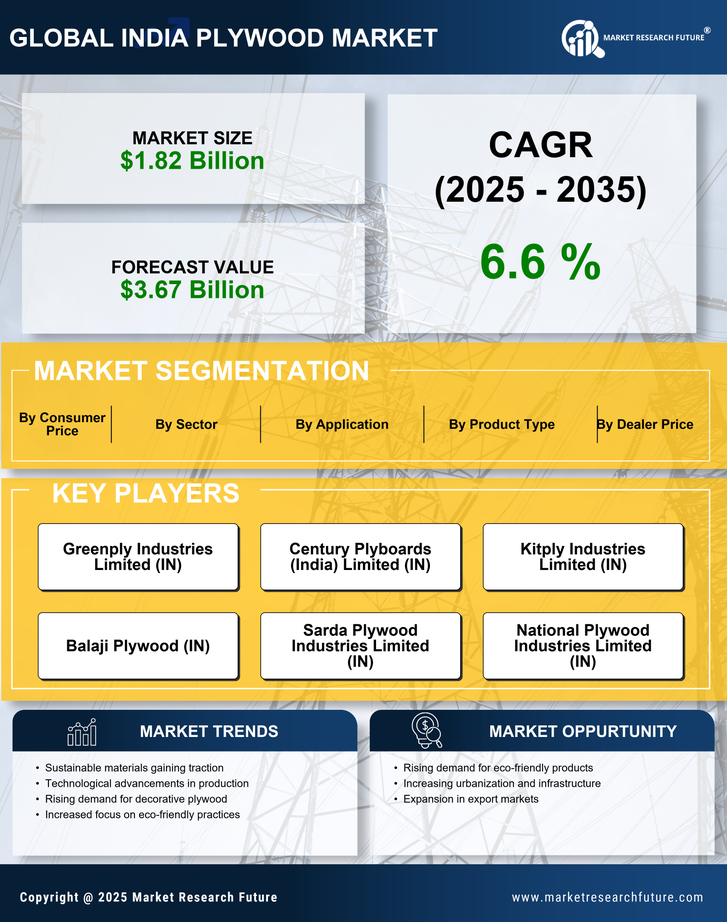

Rising Demand for Eco-Friendly Products

The increasing consumer awareness regarding environmental sustainability appears to be a pivotal driver for the India Plywood Market. As more individuals and businesses seek eco-friendly alternatives, the demand for plywood made from sustainable sources is likely to rise. This trend is reflected in the growing preference for products certified by organizations that promote responsible forestry practices. In 2025, the market for green building materials, including eco-friendly plywood, is projected to expand significantly, potentially reaching a valuation of several billion dollars. This shift towards sustainability not only aligns with The India Plywood Industry to innovate and adopt greener production methods.

Government Initiatives and Policy Support

Government initiatives aimed at boosting the manufacturing sector are likely to play a vital role in shaping the India Plywood Market. Policies that promote local production and reduce import duties on raw materials can enhance the competitiveness of domestic plywood manufacturers. In 2025, various schemes designed to support small and medium enterprises in the woodworking sector may lead to increased investment in technology and infrastructure. This supportive environment could foster innovation and growth within the India Plywood Market, enabling manufacturers to meet the evolving needs of consumers and capitalize on emerging market opportunities.

Technological Innovations in Manufacturing

Technological advancements in manufacturing processes are transforming the India Plywood Market. Innovations such as automated production lines and advanced adhesive technologies are enhancing the efficiency and quality of plywood production. These developments not only reduce production costs but also improve the durability and aesthetic appeal of plywood products. In 2025, it is anticipated that manufacturers who adopt these technologies will gain a competitive edge, as they can offer superior products at competitive prices. Furthermore, the integration of digital tools for inventory management and supply chain optimization is likely to streamline operations, thereby meeting the growing demand in the India Plywood Market more effectively.

Growth in Real Estate and Construction Sectors

The robust expansion of the real estate and construction sectors in India is a crucial driver for the India Plywood Market. With urbanization continuing to accelerate, the demand for residential and commercial properties is on the rise. In 2025, the construction industry is expected to contribute substantially to the national GDP, thereby increasing the need for high-quality plywood for various applications, including flooring, cabinetry, and furniture. This growth is further supported by government initiatives aimed at enhancing infrastructure, which could lead to a surge in plywood consumption. Consequently, the India Plywood Market stands to benefit from this upward trajectory, as builders and developers increasingly rely on plywood for their projects.

Increasing Preference for Modular and Prefabricated Structures

The rising trend towards modular and prefabricated construction is emerging as a significant driver for the India Plywood Market. As builders and architects seek to reduce construction time and costs, the use of plywood in modular designs is becoming increasingly popular. This method not only allows for faster assembly but also minimizes waste, aligning with sustainability goals. In 2025, the market for prefabricated buildings is expected to witness substantial growth, which could lead to a corresponding increase in plywood demand. Consequently, the India Plywood Market is likely to adapt to this trend by offering specialized products tailored for modular construction applications.