Focus on Preventive Healthcare

The growing emphasis on preventive healthcare is emerging as a key driver in the India physician groups market. With an increasing awareness of health and wellness, patients are seeking preventive services such as regular check-ups, screenings, and lifestyle management programs. This shift towards preventive care is prompting physician groups to adapt their service offerings to include wellness programs and health education initiatives. As of January 2026, it is estimated that preventive healthcare services have seen a growth rate of approximately 25% in urban centers. This trend not only helps in reducing the burden of chronic diseases but also positions physician groups as proactive health partners, potentially leading to long-term patient relationships and increased revenue streams.

Collaboration and Network Expansion

Collaboration among healthcare providers is becoming increasingly vital in the India physician groups market. Physician groups are forming networks and alliances to enhance service delivery and patient care. This collaborative approach allows for shared resources, knowledge exchange, and improved patient outcomes. As of January 2026, many physician groups are engaging in partnerships with hospitals and specialty clinics to offer comprehensive care solutions. Such collaborations are particularly beneficial in managing complex cases that require multidisciplinary approaches. Additionally, the expansion of networks enables physician groups to leverage economies of scale, thereby reducing operational costs and improving service efficiency. This trend towards collaboration is likely to strengthen the competitive positioning of physician groups in the evolving healthcare landscape.

Government Policies and Initiatives

The India physician groups market is significantly shaped by government policies and initiatives aimed at improving healthcare access and quality. The National Health Policy 2017 emphasizes the need for comprehensive healthcare services, which has led to increased funding and support for healthcare providers, including physician groups. As of January 2026, various state governments are implementing schemes to incentivize the establishment of healthcare facilities in rural areas, thereby expanding the reach of physician groups. Additionally, the introduction of the Ayushman Bharat scheme has facilitated access to health insurance for millions, further driving demand for physician services. These supportive policies are likely to enhance the operational landscape for physician groups, fostering growth and sustainability in the market.

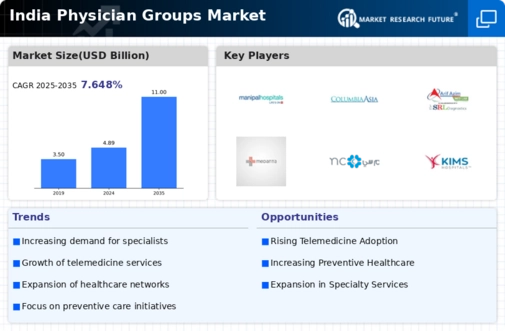

Rising Demand for Healthcare Services

The India physician groups market is experiencing a notable increase in demand for healthcare services, driven by a growing population and rising health awareness. As of January 2026, the population of India is estimated to be over 1.4 billion, leading to a higher prevalence of chronic diseases and a greater need for specialized medical care. This surge in demand is prompting physician groups to expand their services and improve accessibility. Furthermore, the increasing disposable income among the middle class is enabling more individuals to seek medical attention, thereby contributing to the growth of the physician groups market. The government initiatives aimed at enhancing healthcare infrastructure also play a crucial role in supporting this demand, indicating a robust future for the industry.

Technological Advancements in Healthcare

Technological advancements are significantly influencing the India physician groups market, as innovations in medical technology and telemedicine reshape patient care. The integration of digital health solutions, such as electronic health records and teleconsultation platforms, is enhancing the efficiency and effectiveness of healthcare delivery. As of January 2026, it is estimated that telemedicine usage has increased by over 30% in urban areas, allowing physician groups to reach a broader patient base. These advancements not only improve patient outcomes but also streamline administrative processes within physician groups. The ongoing investment in health tech startups and collaborations with technology firms further indicates a trend towards modernization in the healthcare sector, which is likely to bolster the physician groups market in India.