Rising Energy Demand

The increasing energy demand in India is a crucial driver for the photovoltaic market. As the population grows and urbanization accelerates, the need for sustainable energy sources becomes more pressing. The Indian government aims to achieve 450 GW of renewable energy capacity by 2030, with a significant portion expected to come from solar energy. This ambitious target indicates a strong commitment to expanding the photovoltaic market. Furthermore, the energy consumption in India is projected to rise by 4.2% annually, which could lead to a substantial increase in the installation of solar panels. The growing demand for electricity, coupled with the need for cleaner energy solutions, positions the photovoltaic market as a vital component of India's energy strategy.

Technological Innovations

Technological advancements are significantly influencing the photovoltaic market in India. Innovations in solar panel efficiency, energy storage solutions, and smart grid technologies are enhancing the overall performance and reliability of solar energy systems. For instance, the development of bifacial solar panels, which can capture sunlight from both sides, has the potential to increase energy generation by up to 30%. Moreover, the integration of battery storage systems allows for better energy management, enabling consumers to utilize solar energy even during non-sunny hours. As these technologies become more accessible and affordable, they are likely to stimulate further growth in the photovoltaic market. The ongoing research and development efforts in India are expected to yield even more efficient solutions, thereby solidifying the country's position in the global solar landscape.

Favorable Regulatory Framework

India's regulatory environment plays a pivotal role in shaping the photovoltaic market. The government has implemented various policies and incentives to promote solar energy adoption, such as the Solar Park Scheme and the National Solar Mission. These initiatives aim to simplify the process of setting up solar projects and provide financial support to developers. Additionally, the introduction of net metering policies allows consumers to sell excess energy back to the grid, enhancing the economic viability of solar installations. As of 2025, the cumulative installed solar capacity in India has reached approximately 60 GW, reflecting the effectiveness of these regulatory measures. This supportive framework is likely to continue driving growth in the photovoltaic market, attracting both domestic and international investments.

Investment in Renewable Energy

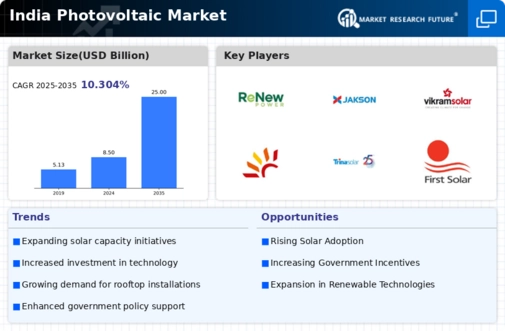

Investment trends in renewable energy are a significant driver for the photovoltaic market in India. The country has attracted substantial foreign direct investment (FDI) in the renewable sector, with solar energy being a primary focus. In 2025, the total FDI in the renewable energy sector is estimated to exceed $10 billion, reflecting the growing confidence of investors in India's solar potential. This influx of capital is crucial for financing large-scale solar projects and infrastructure development. Furthermore, public-private partnerships are becoming increasingly common, facilitating the sharing of resources and expertise. As investment continues to flow into the photovoltaic market, it is likely to accelerate the deployment of solar technologies and enhance the overall competitiveness of the sector.

Environmental Concerns and Sustainability

Environmental awareness and the push for sustainability are driving factors for the photovoltaic market in India. With rising concerns about climate change and pollution, there is a growing recognition of the need for cleaner energy sources. The Indian government has committed to reducing carbon emissions by 33-35% by 2030, which necessitates a shift towards renewable energy. Solar power, being abundant and sustainable, is positioned as a key solution to meet these environmental goals. Public sentiment is increasingly favoring green technologies, leading to higher adoption rates of solar energy systems among consumers and businesses alike. As the demand for sustainable energy solutions grows, the photovoltaic market is likely to experience robust growth, aligning with both national and global sustainability objectives.