Increased Focus on Passenger Safety

Passenger safety has become a paramount concern in India, driving the demand for advanced information systems. The implementation of systems that provide real-time alerts and updates regarding safety measures is crucial for enhancing commuter confidence. The passenger information-system market is likely to see a surge in demand for features such as emergency notifications and route optimization to ensure safety. As public transport authorities prioritize safety, investments in these systems are expected to rise, potentially increasing market value by 20% over the next few years. This focus on safety is reshaping the landscape of the passenger information-system market.

Growing Demand for Eco-Friendly Solutions

The increasing awareness of environmental issues is influencing the passenger information-system market in India. There is a growing demand for eco-friendly transport solutions that minimize carbon footprints. Passenger information systems that promote the use of public transport and provide information on sustainable travel options are gaining traction. The market is likely to benefit from government incentives aimed at reducing emissions, with projections indicating a potential growth of 25% in eco-friendly system implementations. This trend reflects a broader shift towards sustainability in the passenger information-system market, aligning with global environmental goals.

Government Initiatives for Smart Transport

The Indian government is actively promoting smart transportation systems, which significantly influences the passenger information-system market. Initiatives such as the Smart Cities Mission aim to enhance urban mobility through advanced technologies. This includes the implementation of integrated passenger information systems that provide real-time updates and improve user experience. The government's investment in infrastructure development, estimated at over $1 trillion, is expected to bolster the market. Furthermore, policies encouraging public-private partnerships are likely to facilitate the adoption of innovative solutions in the passenger information-system market, thereby enhancing operational efficiency and passenger satisfaction.

Rising Urbanization and Population Density

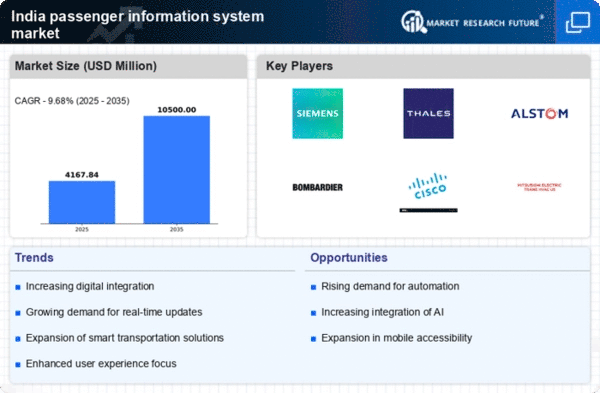

India's rapid urbanization, with over 34% of its population residing in urban areas, is a critical driver for the passenger information-system market. As cities expand, the demand for efficient public transport systems increases, necessitating the implementation of advanced passenger information systems. These systems are essential for managing the complexities of urban mobility, providing timely information to commuters, and reducing congestion. The market is projected to grow at a CAGR of approximately 15% over the next five years, driven by the need for improved transport solutions in densely populated areas. This trend indicates a robust opportunity for stakeholders in the passenger information-system market.

Technological Advancements in Communication

The advent of advanced communication technologies, such as 5G and IoT, is transforming the passenger information-system market in India. These technologies enable seamless connectivity and real-time data sharing, enhancing the efficiency of passenger information systems. With the increasing penetration of smartphones, the demand for mobile applications that provide real-time updates is on the rise. It is estimated that by 2026, mobile-based passenger information systems could account for over 40% of the market share. This shift towards digital solutions indicates a significant opportunity for innovation and growth within the passenger information-system market.