Advancements in Stem Cell Research

Recent advancements in stem cell research are significantly impacting the organoids market in India. The ability to derive organoids from pluripotent stem cells has opened new avenues for regenerative medicine and disease modeling. This progress is likely to attract investment and foster collaborations among academic institutions and biotech firms. The Indian government has recognized the potential of stem cell research, leading to increased funding and support for related initiatives. As a result, the organoids market is expected to expand, driven by the growing interest in stem cell-derived organoids for therapeutic applications.

Rising Prevalence of Chronic Diseases

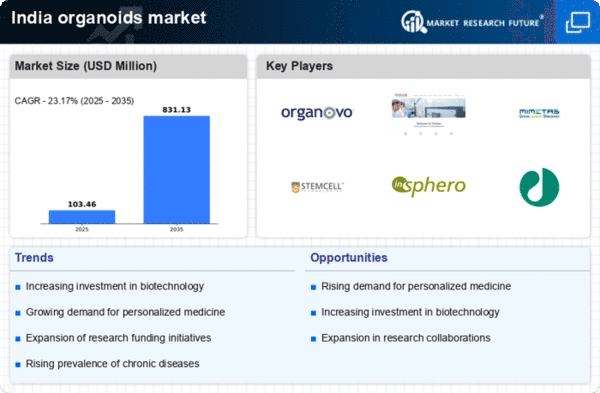

The rising prevalence of chronic diseases in India is a critical driver for the organoids market. Conditions such as diabetes, cancer, and cardiovascular diseases are becoming increasingly common, necessitating innovative research and treatment approaches. Organoids provide a platform for studying disease mechanisms and testing new therapies, which is essential for addressing these health challenges. The market for chronic disease management is projected to reach $100 billion by 2026, highlighting the urgent need for effective solutions. Consequently, the organoids market is likely to benefit from this growing demand for advanced research tools.

Growing Demand for Personalized Medicine

The increasing focus on personalized medicine is driving the organoids market in India. As healthcare shifts towards tailored treatments, organoids offer a promising avenue for drug testing and disease modeling. This trend is particularly relevant in oncology, where organoids can mimic patient-specific tumors, allowing for more effective treatment strategies. The market for personalized medicine is projected to grow at a CAGR of approximately 10% in the coming years, indicating a robust demand for organoid technologies. This growth is likely to enhance the organoids market, as researchers and pharmaceutical companies seek innovative solutions to improve patient outcomes.

Supportive Government Policies and Funding

Supportive government policies and funding initiatives are playing a pivotal role in the growth of the organoids market in India. The government has recognized the importance of biotechnology and has implemented various schemes to promote research and development in this field. Funding for biotech startups and research institutions is increasing, which is likely to foster innovation in organoid technologies. Additionally, initiatives aimed at enhancing public-private partnerships are expected to further stimulate growth. As a result, the organoids market is likely to thrive, benefiting from the conducive regulatory environment and financial support.

Increased Focus on Drug Development Efficiency

The organoids market is experiencing growth due to an increased focus on drug development efficiency. Traditional drug testing methods are often time-consuming and costly, leading to a demand for more effective alternatives. Organoids can streamline the drug discovery process by providing more accurate models for human biology. This efficiency is particularly appealing to pharmaceutical companies looking to reduce R&D costs, which can average around $2.6 billion per new drug. As the industry seeks to enhance productivity, the organoids market is poised for expansion, driven by the need for innovative drug testing solutions.