Growing Awareness of Eye Health

Growing awareness of eye health among the Indian population is emerging as a vital driver for the ophthalmic knives market. Public health campaigns and educational initiatives are increasingly informing individuals about the importance of regular eye check-ups and timely surgical interventions. This heightened awareness is leading to more people seeking medical attention for eye-related issues, thereby increasing the demand for surgical procedures. As a result, healthcare providers are likely to invest in advanced surgical instruments, including ophthalmic knives, to meet this rising demand. The India ophthalmic knives market stands to benefit from this trend, as more patients opt for surgical solutions to address their eye health concerns. The combination of increased awareness and the availability of advanced surgical options is expected to drive growth in this market.

Increasing Healthcare Expenditure

The increasing healthcare expenditure in India is a significant driver for the ophthalmic knives market. As the government and private sectors invest more in healthcare infrastructure, the availability of advanced surgical instruments is improving. The National Health Policy aims to increase public health expenditure to 2.5% of GDP by 2025, which could lead to enhanced healthcare services, including eye care. This increase in funding is likely to facilitate the procurement of modern ophthalmic surgical instruments, including knives, thereby boosting the market. Furthermore, as more healthcare facilities adopt advanced technologies and improve their surgical capabilities, the demand for high-quality ophthalmic knives is expected to rise, contributing to the overall growth of the India ophthalmic knives market.

Rising Incidence of Eye Disorders

The rising incidence of eye disorders in India is a critical driver for the ophthalmic knives market. With an increasing population and changing lifestyles, conditions such as cataracts, glaucoma, and diabetic retinopathy are becoming more prevalent. Reports indicate that by 2025, the number of people suffering from visual impairment in India could reach 20 million. This alarming trend necessitates the need for effective surgical interventions, thereby boosting the demand for specialized surgical instruments, including ophthalmic knives. As healthcare facilities expand and improve their capabilities to address these eye disorders, the India ophthalmic knives market is poised for growth. The increasing awareness of eye health and the importance of timely surgical intervention further contribute to the rising demand for these essential surgical tools.

Government Support for Local Manufacturing

Government initiatives aimed at promoting local manufacturing are significantly impacting the India ophthalmic knives market. Policies such as 'Make in India' encourage domestic production of medical devices, including surgical instruments. This initiative not only aims to reduce dependency on imports but also fosters innovation and quality improvement in the local market. The government has also introduced various incentives for manufacturers, which could lead to a more competitive landscape. As a result, local manufacturers are likely to enhance their production capabilities and invest in research and development. This shift towards local manufacturing is expected to lower costs and improve accessibility to high-quality ophthalmic knives, thereby stimulating growth in the India ophthalmic knives market.

Technological Advancements in Surgical Instruments

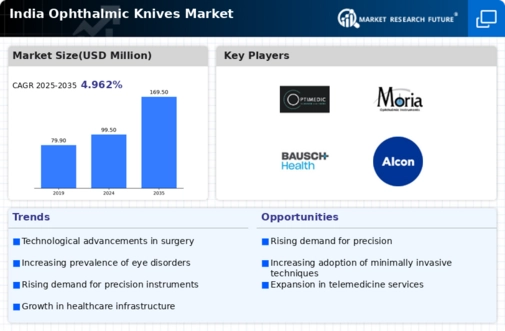

The India ophthalmic knives market is experiencing a notable transformation due to rapid technological advancements in surgical instruments. Innovations such as micro-surgical blades and automated cutting devices are enhancing precision and reducing recovery times for patients. The introduction of advanced materials, such as stainless steel and diamond-coated blades, is also contributing to improved performance and durability. According to recent data, the market for ophthalmic surgical instruments in India is projected to grow at a CAGR of approximately 8% over the next five years. This growth is driven by the increasing demand for minimally invasive surgical procedures, which require specialized instruments like ophthalmic knives. As healthcare providers adopt these advanced technologies, the India ophthalmic knives market is likely to witness significant expansion.