Focus on Enhancing Customer Experience

In India, the operational analytics market is significantly impacted by the focus on enhancing customer experience. Organizations are increasingly leveraging analytics to gain insights into customer behavior and preferences, allowing them to tailor their offerings accordingly. This customer-centric approach is becoming a key driver for businesses seeking to differentiate themselves in a competitive landscape. The operational analytics market is expected to grow as companies invest in tools that provide deeper insights into customer interactions and feedback. Research indicates that businesses that prioritize customer experience can achieve up to a 10% increase in revenue. Consequently, the operational analytics market is likely to expand as organizations recognize the importance of data-driven strategies in improving customer satisfaction and loyalty.

Growing Importance of Real-Time Analytics

The operational analytics market in India is increasingly influenced by the growing importance of real-time analytics. Businesses are recognizing that timely access to data can significantly impact decision-making processes and operational efficiency. As industries such as manufacturing, retail, and logistics evolve, the need for real-time insights becomes paramount. Companies are investing in technologies that facilitate real-time data processing and analytics, allowing them to respond swiftly to market changes and customer demands. This trend is reflected in the operational analytics market, which is expected to witness a growth rate of around 20% annually. The ability to analyze data in real-time not only enhances operational agility but also fosters a culture of proactive decision-making, thereby driving the operational analytics market forward.

Emergence of Advanced Analytics Technologies

The operational analytics market in India is witnessing a transformative phase with the emergence of advanced analytics technologies. Innovations such as predictive analytics, machine learning, and artificial intelligence are reshaping how organizations approach data analysis. These technologies enable businesses to uncover hidden patterns and trends within their data, leading to more informed decision-making. As companies increasingly adopt these advanced analytics solutions, the operational analytics market is expected to grow significantly. Industry reports suggest that the market could reach $5 billion by 2026, driven by the demand for sophisticated analytics capabilities. This shift towards advanced analytics not only enhances operational efficiency but also empowers organizations to anticipate market trends and customer preferences, thereby solidifying their competitive edge.

Rising Demand for Data-Driven Decision Making

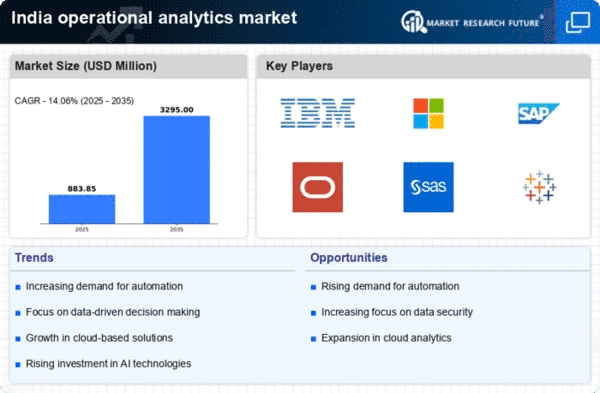

The operational analytics market in India is experiencing a notable surge due to the increasing demand for data-driven decision making across various sectors. Organizations are recognizing the value of leveraging data analytics to enhance operational efficiency and drive strategic initiatives. According to recent estimates, the market is projected to grow at a CAGR of approximately 25% over the next five years. This growth is fueled by the need for real-time insights that can inform business strategies and improve customer experiences. As companies strive to remain competitive, the adoption of operational analytics tools becomes essential, enabling them to analyze vast amounts of data and derive actionable insights. Consequently, this trend is likely to propel the operational analytics market forward, as businesses invest in advanced analytics capabilities to optimize their operations.

Increased Investment in Digital Transformation

In India, the operational analytics market is benefiting from a significant increase in investment in digital transformation initiatives. Organizations across industries are prioritizing the adoption of advanced technologies to streamline operations and enhance productivity. The Indian government has also been promoting digitalization through various initiatives, which further stimulates market growth. Reports indicate that the digital transformation market in India is expected to reach $100 billion by 2025, with a substantial portion allocated to operational analytics solutions. This investment is likely to drive the development and implementation of innovative analytics tools, enabling businesses to harness data effectively. As a result, the operational analytics market is poised for expansion, as companies seek to leverage analytics for improved operational performance and competitive advantage.