Emergence of 5G Technology

The advent of 5G technology is poised to revolutionize the network analytics market in India. With its promise of ultra-fast connectivity and low latency, 5G is expected to drive the adoption of advanced analytics solutions. Organizations will require sophisticated tools to analyze the vast amounts of data generated by 5G networks, enabling them to optimize performance and enhance user experiences. The network analytics market is likely to witness substantial growth as businesses invest in analytics capabilities to leverage the full potential of 5G technology. This transformation presents a unique opportunity for analytics providers to develop innovative solutions tailored to the evolving needs of the market.

Expansion of Digital Infrastructure

The rapid expansion of digital infrastructure in India is significantly impacting the network analytics market. With the government's push for digital transformation and initiatives like Digital India, there is an increasing need for robust network analytics solutions. Organizations are investing in advanced analytics tools to monitor and manage their networks effectively. This investment is crucial for ensuring seamless connectivity and enhancing user experience. The network analytics market is expected to benefit from this trend, as businesses seek to harness the power of analytics to optimize their network operations. The increasing number of internet users and the proliferation of IoT devices further amplify the demand for sophisticated analytics solutions, indicating a promising future for the network analytics market in India.

Rising Focus on Operational Efficiency

In the context of the network analytics market, there is a notable emphasis on improving operational efficiency among Indian enterprises. Organizations are increasingly adopting analytics to streamline their network operations, reduce downtime, and enhance overall productivity. By utilizing network analytics, companies can identify bottlenecks, optimize resource allocation, and improve service delivery. This focus on efficiency is reflected in the growing investments in analytics tools, which are projected to reach approximately $1 billion by 2026. As businesses strive to achieve operational excellence, the network analytics market is likely to see sustained growth, driven by the need for continuous improvement and cost reduction.

Increased Regulatory Compliance Requirements

The network analytics market is also influenced by the rising regulatory compliance requirements in India. Organizations are mandated to adhere to various data protection and privacy regulations, which necessitate the implementation of robust analytics solutions. Network analytics plays a crucial role in ensuring compliance by providing insights into data usage, security vulnerabilities, and potential breaches. As companies navigate the complex regulatory landscape, the demand for analytics tools that can facilitate compliance is expected to grow. This trend indicates a significant opportunity for the network analytics market, as businesses seek to mitigate risks and enhance their compliance posture.

Growing Demand for Data-Driven Decision Making

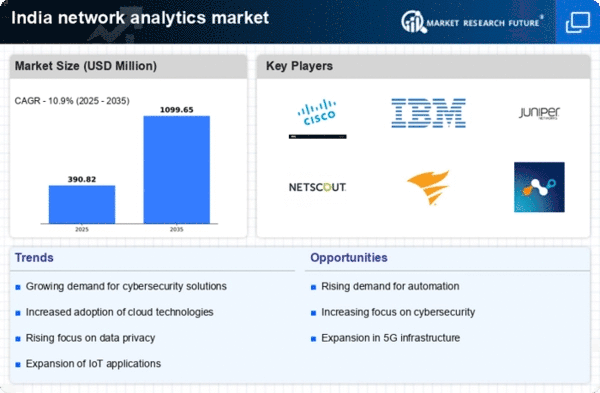

The network analytics market in India is experiencing a surge in demand as organizations increasingly recognize the value of data-driven decision making. Companies are leveraging network analytics to gain insights into customer behavior, operational efficiency, and market trends. This shift is evident as businesses aim to enhance their competitive edge by utilizing analytics to inform strategic decisions. According to recent estimates, the market is projected to grow at a CAGR of approximately 25% over the next five years. This growth is driven by the need for organizations to optimize their network performance and improve service delivery, thereby fostering a more data-centric culture within enterprises. As a result, the network analytics market is becoming an essential component of business strategy across various sectors in India.