Emergence of IoT Applications

The rise of Internet of Things (IoT) applications is reshaping the mobile front-haul market in India. With the increasing deployment of IoT devices across various sectors, including agriculture, healthcare, and smart cities, there is a growing need for efficient data transmission. The mobile front-haul market must adapt to accommodate the unique requirements of IoT, such as low latency and high reliability. As IoT adoption is expected to grow exponentially, telecom operators are likely to invest in upgrading their front-haul networks to support these applications. This shift could lead to the development of specialized solutions tailored for IoT connectivity, thereby expanding the market's scope. The mobile front-haul market is poised to capitalize on this trend, potentially driving innovation and enhancing service offerings.

Government Initiatives and Policy Support

The Indian government is actively promoting the expansion of digital infrastructure, which significantly impacts the mobile front-haul market. Initiatives such as the Digital India program aim to enhance connectivity across urban and rural areas. The government's push for 5G deployment and the allocation of spectrum for telecom operators are expected to stimulate investments in mobile front-haul technologies. Furthermore, policy frameworks that encourage public-private partnerships may facilitate the development of robust networks. As a result, the mobile front-haul market is likely to benefit from increased funding and support, enabling operators to upgrade their infrastructure and improve service delivery. This supportive environment could lead to a more competitive landscape, ultimately enhancing consumer access to high-quality mobile services.

Rising Demand for High-Speed Connectivity

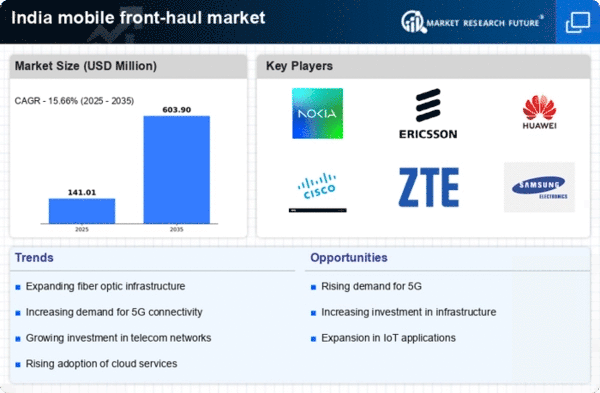

The mobile front-haul market in India is experiencing a surge in demand for high-speed connectivity, driven by the increasing reliance on mobile data services. With mobile data traffic projected to grow at a CAGR of 30% over the next few years, telecom operators are compelled to enhance their infrastructure. This demand is further fueled by the proliferation of smart devices and the growing popularity of streaming services. As consumers seek faster and more reliable internet access, the mobile front-haul market must adapt to these evolving needs. Investments in advanced technologies, such as fiber optics and microwave backhaul, are likely to play a crucial role in meeting this demand. Consequently, the mobile front-haul market is positioned for substantial growth as operators strive to deliver superior connectivity solutions.

Increased Competition Among Telecom Operators

The competitive landscape among telecom operators in India is intensifying, which is influencing the mobile front-haul market. As operators strive to differentiate themselves, there is a growing emphasis on enhancing network performance and service quality. This competition is likely to drive investments in advanced mobile front-haul technologies, as operators seek to optimize their infrastructure. The mobile front-haul market may witness a shift towards more innovative solutions, such as software-defined networking (SDN) and network function virtualization (NFV), which can improve operational efficiency. Additionally, the need to retain customers in a saturated market may prompt operators to offer more attractive pricing and service packages. Consequently, this competitive environment could lead to accelerated growth and technological advancements within the mobile front-haul market.

Technological Advancements in Network Infrastructure

Technological advancements are playing a pivotal role in shaping the mobile front-haul market in India. Innovations in network infrastructure, such as the deployment of 5G technology and the integration of artificial intelligence (AI) for network management, are expected to enhance the efficiency and reliability of mobile services. The mobile front-haul market is likely to benefit from these advancements, as they enable operators to optimize their networks and reduce operational costs. Furthermore, the adoption of next-generation technologies, including millimeter-wave communication and advanced fiber optics, could facilitate higher data transmission rates. As these technologies become more accessible, the mobile front-haul market may experience a transformation, leading to improved service delivery and customer satisfaction.