Regulatory Framework and Policy Support

The regulatory framework and policy support in India play a crucial role in shaping the medium voltage-cables market. The government has implemented various policies aimed at enhancing the power sector's efficiency and reliability. Initiatives such as the National Electricity Policy and the Electricity Act provide a conducive environment for investment in power infrastructure. These policies encourage the adoption of medium voltage-cables as they are essential for modernizing the electricity distribution network. Furthermore, the government's commitment to achieving universal access to electricity by 2022 has led to increased investments in power infrastructure, thereby driving the medium voltage-cables market. The alignment of regulatory support with market needs is likely to foster growth and innovation in this sector.

Investment in Infrastructure Development

Infrastructure development in India is a critical driver for the medium voltage-cables market. The government has allocated substantial funds for the enhancement of power infrastructure, including transmission and distribution networks. Recent reports indicate that the Indian government plans to invest over $20 billion in the power sector by 2025, which is expected to significantly boost the medium voltage-cables market. This investment is aimed at modernizing the existing grid and expanding access to electricity in rural and semi-urban areas. As a result, the demand for medium voltage-cables is anticipated to rise, driven by the need for reliable and efficient power distribution systems. Additionally, the focus on improving energy efficiency and reducing transmission losses will further propel the market.

Technological Innovations in Cable Design

Technological advancements in cable design and manufacturing processes are transforming the medium voltage-cables market. Innovations such as improved insulation materials and enhanced conductor designs are leading to the production of more efficient and durable cables. These advancements not only improve the performance of medium voltage-cables but also reduce installation and maintenance costs. The introduction of smart cables, which can monitor their own condition and performance, is also gaining traction in the market. As industries and utilities seek to optimize their operations, the demand for technologically advanced medium voltage-cables is likely to increase. This trend indicates a shift towards more sustainable and efficient power distribution systems, aligning with the broader goals of energy conservation and management.

Growing Industrialization and Urbanization

The rapid industrialization and urbanization in India are pivotal factors influencing the medium voltage-cables market. As industries expand and urban areas grow, the demand for robust electrical infrastructure increases. The medium voltage cables market is likely to benefit from this trend, as these cables are essential for connecting industrial facilities and urban developments to the power grid. The manufacturing sector, in particular, is expected to witness significant growth, contributing to the overall demand for medium voltage-cables. With the Indian government promoting initiatives such as 'Make in India', the industrial sector is projected to grow at a CAGR of around 7% over the next few years, further driving the need for efficient power distribution solutions.

Rising Demand for Electricity Distribution

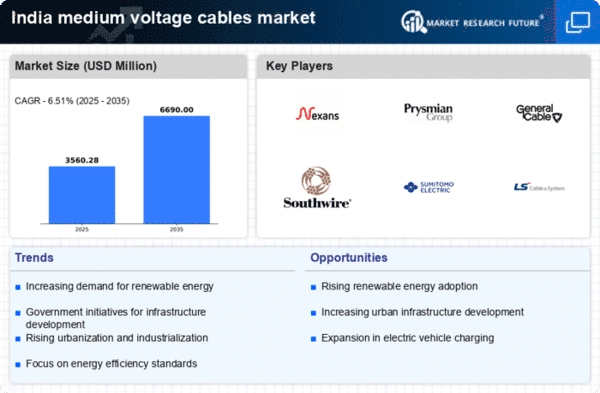

The medium voltage cables market in India is experiencing a notable surge in demand due to the increasing need for electricity distribution. As urbanization accelerates, the requirement for reliable power supply systems becomes paramount. The government has initiated various projects aimed at enhancing the electricity distribution network, which is expected to drive the medium voltage-cables market. According to recent estimates, the demand for electricity in India is projected to grow at a CAGR of approximately 6.5% over the next decade. This growth necessitates the expansion of existing infrastructure, thereby creating opportunities for medium voltage-cables. Furthermore, the push for smart grid technologies is likely to further augment the demand for these cables, as they are essential for efficient energy management and distribution.