Technological Innovations

Technological innovations are reshaping the medical vacuum-systems market in India. The introduction of advanced features such as automated controls, energy-efficient designs, and enhanced safety mechanisms is attracting healthcare providers. These innovations not only improve the efficiency of vacuum systems but also reduce operational costs. For instance, the integration of smart technologies allows for real-time monitoring and maintenance alerts, which can significantly enhance system reliability. As healthcare facilities increasingly seek to modernize their equipment, the demand for technologically advanced medical vacuum systems is expected to grow. This trend indicates a shift towards more sophisticated solutions that align with the evolving needs of the healthcare sector.

Focus on Infection Control

Infection control remains a critical concern in healthcare settings, driving the medical vacuum-systems market in India. The increasing awareness of hospital-acquired infections (HAIs) has led healthcare facilities to prioritize the implementation of stringent infection control measures. Medical vacuum systems play a vital role in maintaining sterile environments during surgical procedures and in the management of biohazardous waste. As hospitals aim to reduce HAIs, the demand for effective vacuum systems is likely to rise. Furthermore, regulatory bodies are emphasizing the need for compliance with infection control protocols, which may further stimulate the market as facilities invest in advanced vacuum technologies to meet these standards.

Surge in Surgical Procedures

The medical vacuum-systems market is significantly influenced by the surge in surgical procedures across India. With an increase in the prevalence of chronic diseases and a growing aging population, the demand for surgical interventions is on the rise. Reports suggest that the number of surgeries performed annually in India is expected to increase by over 20% in the coming years. This escalation in surgical activities necessitates the use of reliable medical vacuum systems to ensure patient safety and effective waste management. As hospitals and surgical centers strive to enhance their operational efficiency, the integration of advanced vacuum systems becomes crucial, thereby propelling market growth.

Rising Healthcare Expenditure

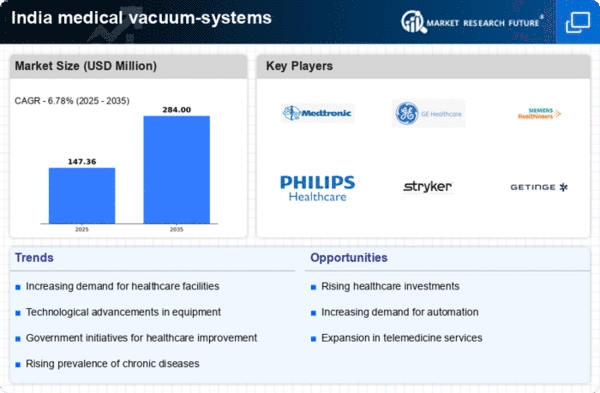

The medical vacuum-systems market in India is experiencing growth due to the increasing healthcare expenditure by both the government and private sectors. As healthcare budgets expand, hospitals and clinics are investing more in advanced medical equipment, including vacuum systems. According to recent data, healthcare spending in India is projected to reach approximately $370 billion by 2025, which indicates a robust demand for efficient medical technologies. This trend is likely to enhance the adoption of medical vacuum systems, as they are essential for various surgical and diagnostic procedures. Furthermore, the push for better healthcare infrastructure in rural and urban areas is expected to drive the market further, as more facilities seek to comply with modern healthcare standards.

Expansion of Healthcare Infrastructure

The expansion of healthcare infrastructure in India is a pivotal driver for the medical vacuum-systems market. With the government's initiatives to improve healthcare access, numerous new hospitals and clinics are being established, particularly in underserved regions. This expansion is accompanied by a growing emphasis on equipping these facilities with modern medical technologies, including vacuum systems. As per estimates, the number of hospitals in India is projected to increase by 30% by 2027, creating a substantial demand for medical vacuum systems. This trend not only supports the growth of the market but also enhances the overall quality of healthcare services provided to the population.