Growing Aging Population

India's demographic shift towards an aging population is a crucial driver for the medical disposables market. By 2025, it is estimated that the elderly population will exceed 140 million, leading to an increased prevalence of chronic diseases and a higher demand for medical care. This demographic change necessitates the use of various medical disposables, such as syringes, catheters, and wound care products, to manage health conditions effectively. Healthcare providers are likely to adopt more disposable products to cater to the specific needs of older patients, who may require frequent medical interventions. The growing aging population thus presents a substantial opportunity for the medical disposables market, as it compels healthcare systems to adapt and enhance their service offerings.

Rising Healthcare Expenditure

The medical disposables market in India is experiencing growth due to the increasing healthcare expenditure by both the government and private sectors. As the Indian government allocates more funds to healthcare, the demand for medical disposables is likely to rise. In 2025, healthcare spending is projected to reach approximately $370 billion, which indicates a significant increase from previous years. This rise in expenditure is expected to enhance the availability and accessibility of medical services, thereby driving the demand for various medical disposables. Hospitals and clinics are increasingly investing in disposable products to ensure patient safety and reduce the risk of cross-contamination. Consequently, this trend is anticipated to bolster the medical disposables market, as healthcare facilities prioritize the use of single-use products to maintain hygiene standards.

Expansion of Healthcare Infrastructure

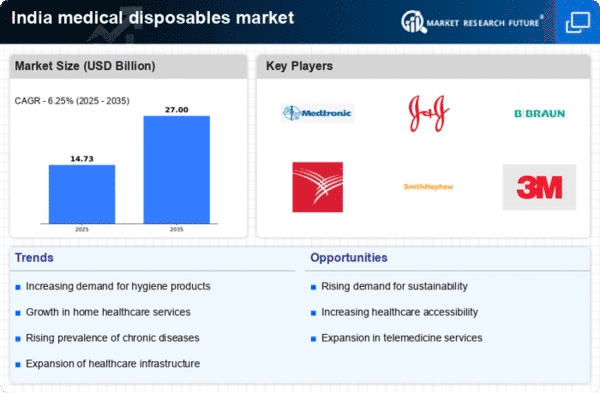

The expansion of healthcare infrastructure in India is significantly impacting the medical disposables market. With the establishment of new hospitals, clinics, and diagnostic centers, the demand for medical disposables is expected to surge. The government has initiated various programs to improve healthcare access, particularly in rural areas, which is likely to increase the number of healthcare facilities. As of 2025, the number of hospitals in India is projected to reach over 70,000, creating a substantial market for medical disposables. This expansion is accompanied by a growing awareness of hygiene and safety standards, prompting healthcare providers to opt for disposable products. Consequently, The medical disposables market is poised for growth. This growth is expected as healthcare infrastructure continues to develop.

Increased Awareness of Health and Hygiene

There is a notable increase in awareness regarding health and hygiene among the Indian population, which is driving the medical disposables market. As individuals become more conscious of the importance of sanitation, the demand for disposable medical products is likely to rise. Educational campaigns and government initiatives aimed at promoting hygiene practices are contributing to this trend. For instance, the use of disposable gloves, masks, and other protective gear is becoming commonplace in both healthcare settings and everyday life. This heightened awareness is expected to lead to a greater acceptance of medical disposables, as consumers prioritize safety and cleanliness. As a result, the medical disposables market is likely to benefit from this cultural shift towards improved health practices.

Technological Innovations in Product Development

Technological innovations are playing a pivotal role in shaping the medical disposables market in India. Advances in materials science and manufacturing processes are leading to the development of more efficient and effective disposable products. Innovations such as biodegradable materials and smart disposables are emerging, catering to the growing demand for sustainable and user-friendly options. The introduction of these advanced products is likely to attract healthcare providers who are seeking to enhance patient care while minimizing environmental impact. As technology continues to evolve, the medical disposables market is expected to witness a transformation, with new products that offer improved functionality and safety. This trend indicates a promising future for the market as it adapts to the changing needs of healthcare providers and patients.