Government Initiatives and Support

Government initiatives aimed at boosting the manufacturing sector in India are significantly impacting the manufacturing analytics market. Programs such as 'Make in India' and 'Digital India' are encouraging manufacturers to adopt advanced technologies, including analytics. The government has allocated substantial funding to promote digital transformation, which is expected to reach approximately $1 billion by 2025. This financial support is likely to facilitate the integration of analytics into manufacturing processes, enhancing productivity and innovation. As manufacturers align with government policies, the manufacturing analytics market is poised for growth, driven by increased adoption of data-driven strategies.

Rising Demand for Operational Efficiency

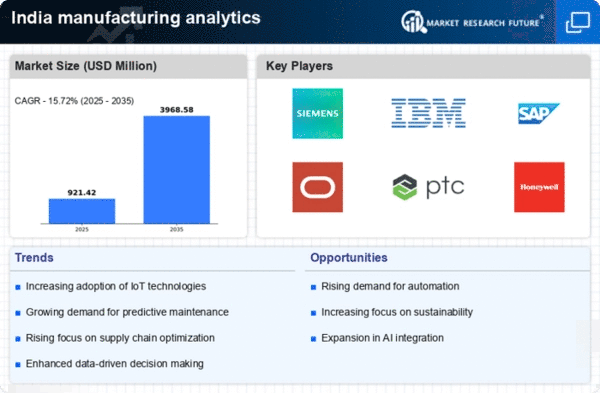

The manufacturing analytics market in India is experiencing a notable surge in demand for operational efficiency. As industries strive to enhance productivity, analytics tools are being increasingly adopted to streamline processes. According to recent data, manufacturers that leverage analytics can achieve up to 20% improvement in operational efficiency. This trend is driven by the need to reduce waste and optimize resource allocation. Companies are investing in advanced analytics solutions to gain insights into production workflows, enabling them to make data-driven decisions. The focus on operational efficiency is likely to propel the growth of the manufacturing analytics market. Organizations seek to remain competitive in a rapidly evolving landscape.

Advancements in Data Processing Technologies

Advancements in data processing technologies are playing a pivotal role in shaping the manufacturing analytics market in India. The emergence of big data and cloud computing has enabled manufacturers to process vast amounts of data in real-time. This capability allows for more accurate analytics and timely decision-making. As organizations increasingly rely on data-driven insights, the market for analytics solutions is expected to expand. The integration of machine learning and artificial intelligence into analytics tools further enhances their effectiveness, providing manufacturers with predictive capabilities that can lead to improved operational outcomes.

Growing Importance of Supply Chain Optimization

Supply chain optimization is becoming increasingly critical for manufacturers in India, thereby influencing the manufacturing analytics market. With the rise of e-commerce and global trade, companies are focusing on enhancing their supply chain efficiency. Analytics tools provide valuable insights into inventory management, demand forecasting, and logistics optimization. It is estimated that companies utilizing analytics for supply chain management can reduce costs by up to 15%. This growing emphasis on supply chain optimization is likely to drive the adoption of analytics solutions, as manufacturers seek to improve their responsiveness and agility in a competitive market.

Increased Focus on Sustainability and Compliance

An increased focus on sustainability and compliance among Indian manufacturers is also driving the manufacturing analytics market. As environmental regulations become more stringent, companies are leveraging analytics to monitor and reduce their carbon footprint. Analytics tools can help identify inefficiencies and suggest improvements that align with sustainability goals. Furthermore, compliance with industry standards is becoming essential, and analytics can facilitate adherence to these regulations. This dual focus on sustainability and compliance is likely to propel the growth of the manufacturing analytics market, as organizations seek to enhance their corporate responsibility while maintaining operational efficiency.