Evolving Threat Landscape

The evolving threat landscape in India is a significant driver for the malware protection market. Cybercriminals are continuously developing sophisticated malware variants, making traditional security measures inadequate. In 2025, it is projected that ransomware attacks will increase by 30% in India, prompting organizations to seek advanced malware protection solutions. The emergence of new attack vectors, such as mobile malware and supply chain attacks, further complicates the security environment. As businesses face these escalating threats, the demand for innovative malware protection technologies is likely to surge. This dynamic landscape compels organizations to adopt proactive security strategies, thereby fueling growth in the malware protection market as they invest in cutting-edge solutions to defend against emerging threats.

Increasing Digital Transformation

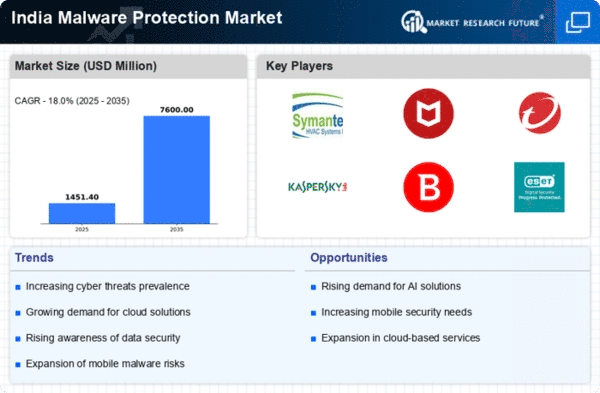

The rapid pace of digital transformation in India is a key driver for the malware protection market. As businesses increasingly adopt cloud computing, mobile applications, and IoT devices, the attack surface for cyber threats expands significantly. In 2025, it is estimated that over 70% of Indian enterprises will have migrated to cloud services, creating a pressing need for robust malware protection solutions. This shift not only enhances operational efficiency but also necessitates advanced security measures to safeguard sensitive data. The malware protection market is likely to see substantial growth as organizations prioritize cybersecurity investments to mitigate risks associated with digital transformation. Furthermore, the increasing reliance on digital platforms for transactions and communications amplifies the urgency for effective malware protection, making it a critical component of business strategy in India.

Rising Awareness of Cybersecurity

There is a growing awareness of cybersecurity threats among Indian consumers and businesses, which is driving the malware protection market. As high-profile cyberattacks make headlines, organizations are becoming more proactive in addressing their security needs. Surveys indicate that approximately 65% of Indian companies plan to increase their cybersecurity budgets in 2025, reflecting a shift in mindset towards prioritizing protection against malware. This heightened awareness is not limited to large enterprises; small and medium-sized businesses are also recognizing the importance of investing in malware protection solutions. Consequently, the malware protection market is expected to expand as more entities seek to implement comprehensive security measures to safeguard their digital assets and maintain customer trust.

Government Initiatives and Policies

The Indian government is actively promoting cybersecurity through various initiatives and policies, which significantly impacts the malware protection market. Programs aimed at enhancing national cybersecurity infrastructure and encouraging public-private partnerships are gaining momentum. For instance, the Cyber Swachhta Kendra initiative aims to create a secure cyberspace by providing free malware protection tools to citizens. Such government efforts are likely to stimulate demand for malware protection solutions across different sectors. Additionally, regulatory frameworks are being established to ensure compliance with cybersecurity standards, further driving the need for effective malware protection. As these initiatives unfold, the malware protection market is poised for growth, with increased investments from both public and private sectors.

Integration of Advanced Technologies

The integration of advanced technologies, such as machine learning and behavioral analytics, is transforming the malware protection market in India. These technologies enhance the ability to detect and respond to threats in real-time, providing a more robust defense against malware attacks. In 2025, it is anticipated that over 50% of malware protection solutions will incorporate AI-driven capabilities, allowing for more effective threat identification and mitigation. This trend indicates a shift towards proactive security measures, where organizations can anticipate and neutralize threats before they cause harm. As businesses increasingly recognize the value of these advanced technologies, the malware protection market is likely to experience significant growth, driven by the demand for innovative solutions that can adapt to the rapidly changing cyber threat landscape.