Increased Focus on Interoperability

Interoperability emerges as a crucial driver in the lte critical-communication market, particularly in India. As various agencies and organizations utilize different communication systems, the need for seamless integration becomes paramount. The push for interoperability ensures that diverse communication platforms can work together effectively, facilitating coordinated responses during emergencies. This focus is reflected in the development of standardized protocols and frameworks that promote compatibility among different systems. The market is likely to see a rise in demand for solutions that enhance interoperability, potentially leading to a market growth of approximately 12% in the coming years. By fostering collaboration among various stakeholders, including government agencies and private sector players, the lte critical-communication market can enhance its overall effectiveness and responsiveness in critical situations.

Government Support and Policy Frameworks

The Indian government plays a pivotal role in shaping the lte critical-communication market through supportive policies and initiatives. Recent government efforts to enhance public safety and security have led to increased funding for communication infrastructure. The allocation of approximately $1 billion for upgrading communication networks in urban areas underscores the commitment to improving emergency response capabilities. Additionally, the establishment of regulatory frameworks that promote the adoption of LTE technology in critical communication systems further stimulates market growth. These policies not only facilitate the deployment of advanced communication solutions but also encourage public-private partnerships, fostering innovation within the lte critical-communication market. As a result, the market is likely to witness accelerated advancements in technology and infrastructure, ultimately enhancing the overall effectiveness of critical communication.

Rising Demand for Reliable Communication

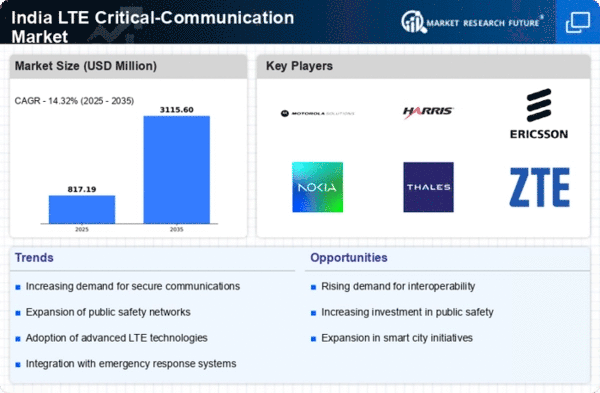

The lte critical-communication market in India experiences a notable surge in demand for reliable communication systems. This demand is primarily driven by the increasing need for uninterrupted communication in sectors such as public safety, emergency services, and disaster management. As urbanization accelerates, the complexity of managing emergencies grows, necessitating robust communication solutions. The market is projected to grow at a CAGR of approximately 15% over the next five years, reflecting the urgency for dependable communication infrastructure. Furthermore, the integration of advanced technologies, such as artificial intelligence and machine learning, enhances the efficiency of communication systems, thereby attracting investments in the lte critical-communication market. This trend indicates a shift towards more resilient communication frameworks that can withstand various challenges, ensuring that critical information is transmitted effectively during emergencies.

Growing Investment in Public Safety Infrastructure

Investment in public safety infrastructure significantly impacts the lte critical-communication market in India. As urban areas expand, the need for robust communication systems to support public safety initiatives becomes increasingly evident. Recent reports indicate that investments in public safety communication infrastructure are expected to reach $500 million by 2026. This influx of capital is likely to enhance the capabilities of emergency services, enabling them to respond more effectively to incidents. Furthermore, the emphasis on smart city initiatives promotes the integration of advanced communication technologies within public safety frameworks. This trend suggests that the lte critical-communication market will continue to evolve, driven by the necessity for improved safety measures and efficient communication systems that can adapt to the growing demands of urban environments.

Technological Advancements in Communication Systems

Technological advancements significantly influence the lte critical-communication market in India. The ongoing evolution of communication technologies, including the deployment of 5G networks, enhances the capabilities of critical communication systems. These advancements enable faster data transmission, improved connectivity, and enhanced reliability, which are essential for emergency services and public safety operations. The market is expected to witness a growth rate of around 20% as organizations increasingly adopt these advanced technologies to improve their communication frameworks. Moreover, the integration of features such as real-time data analytics and location-based services further strengthens the operational efficiency of critical communication systems. This trend suggests that the lte critical-communication market is on the brink of a technological revolution, potentially transforming how critical information is shared and managed during emergencies.