Rising E-commerce Demand

The rapid growth of the e-commerce sector in India is a primary driver for the India logistics software market. With the increasing number of online shoppers, logistics companies are compelled to adopt advanced software solutions to manage their supply chains efficiently. According to recent data, the e-commerce market in India is projected to reach USD 200 billion by 2026, necessitating robust logistics software to handle the surge in demand. This growth is prompting logistics providers to invest in technology that enhances order tracking, inventory management, and last-mile delivery. Consequently, the india logistics software market is witnessing a significant transformation, as companies seek to streamline operations and improve customer satisfaction through innovative software solutions.

Government Policy Support

The Indian government has been actively promoting initiatives aimed at enhancing the logistics sector, which in turn drives the India logistics software market. Policies such as the National Logistics Policy and the Gati Shakti initiative are designed to improve infrastructure and reduce logistics costs. The government aims to reduce logistics costs from 13-14 percent of GDP to around 8 percent by 2025. This focus on efficiency is likely to spur demand for logistics software that can optimize routes, manage fleets, and ensure compliance with regulations. As a result, logistics companies are increasingly adopting software solutions that align with government objectives, thereby propelling the growth of the india logistics software market.

Technological Advancements in Logistics

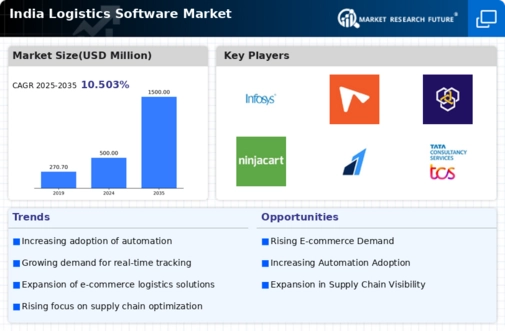

Technological advancements are reshaping the landscape of the India logistics software market. Innovations such as artificial intelligence, machine learning, and the Internet of Things are being integrated into logistics software to enhance efficiency and decision-making. For instance, AI-driven analytics can optimize delivery routes and reduce fuel consumption, while IoT devices provide real-time tracking of shipments. The adoption of these technologies is projected to increase significantly, with the logistics software market in India expected to grow at a CAGR of over 10 percent in the coming years. This trend indicates a shift towards more intelligent logistics solutions, which are essential for meeting the evolving demands of the market.

Increased Focus on Supply Chain Resilience

The need for enhanced supply chain resilience is becoming increasingly apparent in the India logistics software market. Companies are recognizing the importance of having robust logistics systems that can withstand disruptions and ensure continuity. This realization is driving investments in software that provides real-time visibility, predictive analytics, and risk management capabilities. According to industry reports, organizations that invest in advanced logistics software can achieve up to a 30 percent reduction in operational costs. As businesses strive to build more resilient supply chains, the demand for innovative logistics software solutions is expected to rise, further fueling the growth of the india logistics software market.

Growing Demand for Real-time Data Analytics

The growing demand for real-time data analytics is a crucial driver for the India logistics software market. Companies are increasingly seeking software solutions that provide actionable insights into their logistics operations. Real-time analytics enable businesses to monitor performance, identify inefficiencies, and make informed decisions quickly. As per recent studies, organizations utilizing data analytics in logistics can improve their operational efficiency by up to 25 percent. This trend is prompting logistics providers to invest in advanced software that offers comprehensive data analysis capabilities, thereby enhancing their competitiveness in the market. Consequently, the demand for sophisticated logistics software solutions is expected to rise, further propelling the growth of the india logistics software market.