Growing Awareness of Eye Health

The heightened awareness of eye health among the Indian population is a crucial driver for the india keratoconus treatment market. Educational campaigns and initiatives by healthcare providers and organizations have led to increased knowledge about keratoconus and its implications. As individuals become more informed about the symptoms and potential treatments, they are more likely to seek medical advice and intervention. This trend is particularly evident among younger populations, who are increasingly proactive about their health. The rise of digital platforms and social media has further facilitated the dissemination of information, making it easier for patients to access resources. As awareness continues to grow, the india keratoconus treatment market is expected to expand, driven by an informed patient base seeking timely and effective treatment.

Advancements in Medical Technology

Technological innovations in ophthalmology are significantly influencing the india keratoconus treatment market. The introduction of advanced diagnostic tools, such as corneal topography and optical coherence tomography, allows for earlier detection and more accurate assessments of keratoconus. Furthermore, treatment modalities like corneal cross-linking and customized contact lenses have evolved, providing patients with better outcomes. The availability of minimally invasive surgical techniques also enhances patient satisfaction and recovery times. As these technologies become more accessible, healthcare providers are likely to adopt them, thereby expanding the treatment landscape. This trend indicates a robust growth trajectory for the india keratoconus treatment market, as patients increasingly seek out cutting-edge solutions for their eye care needs.

Government Initiatives and Support

Government policies aimed at improving healthcare access and quality are crucial drivers for the india keratoconus treatment market. Initiatives such as the National Health Mission and various state-level programs focus on enhancing eye care services across the country. These efforts include funding for eye hospitals, training for healthcare professionals, and public awareness campaigns about eye health. By promoting early detection and treatment of conditions like keratoconus, the government is likely to increase patient engagement and treatment uptake. Additionally, partnerships with non-governmental organizations to provide free or subsidized treatments can further stimulate market growth. As these initiatives gain traction, the india keratoconus treatment market is expected to benefit from increased patient access to necessary care.

Increasing Prevalence of Keratoconus

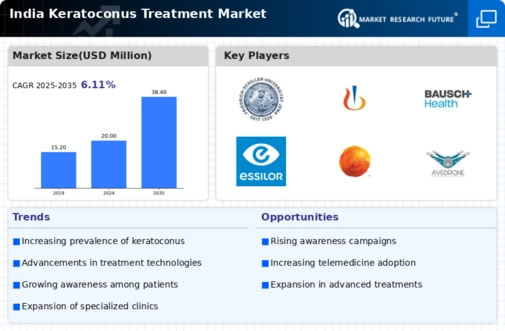

The rising incidence of keratoconus in India is a pivotal driver for the india keratoconus treatment market. Recent studies indicate that the prevalence of keratoconus ranges from 0.5% to 3% in the Indian population, suggesting a growing need for effective treatment options. This increase in cases is attributed to genetic factors, environmental influences, and lifestyle changes. As awareness about the condition grows, more individuals seek diagnosis and treatment, thereby expanding the market. The demand for specialized care, including corneal cross-linking and advanced contact lenses, is likely to surge, prompting healthcare providers to enhance their offerings. Consequently, the india keratoconus treatment market is poised for growth as healthcare systems adapt to meet the needs of this increasing patient population.

Rising Disposable Incomes and Healthcare Expenditure

The growth of disposable incomes in India is a significant factor driving the india keratoconus treatment market. As more individuals attain higher income levels, they are increasingly willing to invest in their health and well-being. This trend is reflected in the rising expenditure on healthcare services, including specialized treatments for keratoconus. Patients are more likely to seek advanced treatment options, such as corneal transplants and specialized contact lenses, which may have previously been considered unaffordable. The increasing availability of private healthcare facilities also contributes to this trend, as these institutions often provide cutting-edge treatments. Consequently, the india keratoconus treatment market is likely to experience growth as more patients prioritize eye care in their healthcare budgets.