Emergence of 5G Technology

The rollout of 5G technology is poised to revolutionize the intelligent network market in India. With its promise of ultra-fast data speeds and low latency, 5G is expected to enable a new wave of applications and services that require robust network capabilities. This technological advancement is likely to drive demand for intelligent networking solutions that can support the increased data traffic and connectivity requirements. Analysts predict that the 5G segment will contribute significantly to the intelligent network market, potentially accounting for over 40% of the market share by 2027. The integration of 5G with intelligent networking will facilitate smarter cities, enhanced IoT applications, and improved user experiences.

Growing Cybersecurity Concerns

As cyber threats become increasingly sophisticated, the intelligent network market in India is experiencing an increased focus on cybersecurity solutions.. Organizations are prioritizing the implementation of intelligent security measures to protect their networks from potential breaches and attacks. This trend is reflected in the growing investment in cybersecurity technologies, which is expected to reach approximately $3 billion by 2026. The integration of advanced security protocols within intelligent networks is essential for safeguarding sensitive data and maintaining operational integrity. Consequently, the intelligent network market is likely to expand as businesses seek to bolster their defenses against evolving cyber threats.

Increased Focus on Data Analytics

Data analytics is becoming a cornerstone of the intelligent network market in India. Companies are leveraging advanced analytics to gain insights into network performance, user behavior, and potential security threats. The ability to analyze vast amounts of data in real-time allows organizations to make informed decisions and optimize their network resources effectively. As per industry reports, the data analytics segment is expected to account for nearly 30% of the total market share by 2026. This emphasis on data-driven decision-making is likely to propel the intelligent network market forward, as businesses seek to harness the power of analytics to enhance their operational capabilities.

Government Initiatives and Support

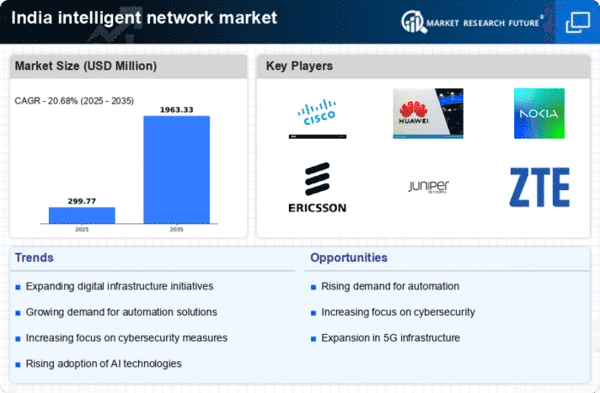

The Indian government is actively promoting the adoption of intelligent network technologies through various initiatives and policies. Programs aimed at enhancing digital infrastructure and encouraging innovation in telecommunications are fostering a conducive environment for the growth of the intelligent network market. For instance, the Digital India initiative aims to transform India into a digitally empowered society and knowledge economy, which is likely to boost investments in intelligent networking solutions. With government backing, the market is expected to witness a compound annual growth rate (CAGR) of around 20% over the next few years, as public and private sectors collaborate to enhance network capabilities.

Rising Demand for Network Automation

The intelligent network market in India is experiencing a notable surge in demand for network automation solutions. This trend is driven by the need for enhanced operational efficiency and reduced human error in network management. Organizations are increasingly adopting automated systems to streamline their network operations, which can lead to cost savings and improved service delivery. According to recent estimates, the automation segment within the intelligent network market is projected to grow at a CAGR of approximately 25% over the next five years. This growth is indicative of a broader shift towards intelligent systems that can adapt and respond to changing network conditions autonomously, thereby enhancing overall network performance.