Growing Surgical Procedures

The increasing number of surgical procedures in India is a primary driver for the hemostasis tissue-sealing-agents market. As healthcare facilities expand and the population ages, the demand for surgical interventions rises. According to recent data, the surgical volume in India is projected to grow at a CAGR of approximately 8% over the next few years. This surge necessitates effective hemostatic solutions to manage bleeding during surgeries, thereby enhancing patient outcomes. The hemostasis tissue-sealing-agents market is likely to benefit from this trend, as surgeons seek reliable products to ensure safety and efficiency. Furthermore, the rise in elective surgeries, including orthopedic and cardiovascular procedures, further propels the need for advanced hemostatic agents, indicating a robust growth trajectory for the industry.

Rising Awareness of Surgical Safety

There is a growing awareness of surgical safety among healthcare professionals and patients in India, which drives the hemostasis tissue-sealing-agents market. As the focus on patient safety intensifies, surgeons are increasingly seeking reliable hemostatic solutions to minimize complications during procedures. Educational initiatives and training programs emphasize the importance of effective bleeding control, leading to a higher demand for advanced tissue-sealing agents. This trend indicates a shift towards prioritizing patient outcomes, which is likely to influence purchasing decisions in the healthcare sector. Consequently, the hemostasis tissue-sealing-agents market is expected to expand as healthcare providers align their practices with the growing emphasis on surgical safety.

Advancements in Healthcare Infrastructure

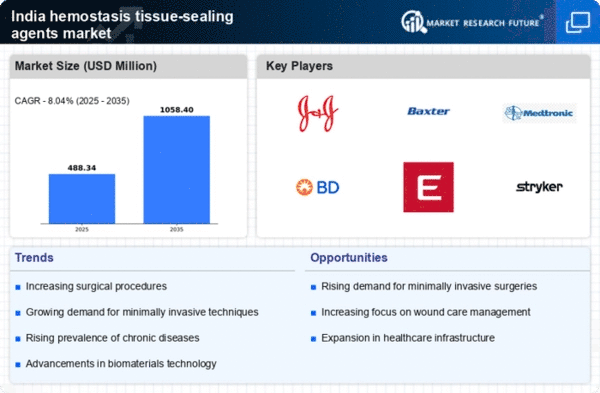

The ongoing improvements in healthcare infrastructure across India serve as a catalyst for the hemostasis tissue-sealing-agents market. With the establishment of new hospitals and surgical centers, there is a heightened demand for advanced medical technologies, including hemostatic agents. The Indian government has been investing significantly in healthcare, aiming to enhance accessibility and quality of care. This investment is likely to lead to an increase in the adoption of innovative surgical techniques and products. As healthcare facilities upgrade their capabilities, the hemostasis tissue-sealing-agents market is expected to experience growth, driven by the need for effective solutions that align with modern surgical practices. The expansion of healthcare infrastructure thus presents a promising landscape for the industry.

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases in India significantly impacts the hemostasis tissue-sealing-agents market. Conditions such as diabetes, cardiovascular diseases, and obesity lead to a higher frequency of surgical interventions. Data suggests that chronic diseases account for nearly 60% of all deaths in India, necessitating surgical procedures that require effective hemostatic solutions. As healthcare providers focus on managing these conditions, the demand for hemostasis tissue-sealing agents is expected to increase. This trend indicates a growing market opportunity, as healthcare systems strive to improve surgical outcomes and reduce complications associated with bleeding. The hemostasis tissue-sealing-agents market is thus positioned to expand in response to the healthcare needs arising from chronic disease management.

Regulatory Support for Medical Innovations

Regulatory bodies in India are increasingly supportive of medical innovations, which positively influences the hemostasis tissue-sealing-agents market. The approval processes for new medical devices and products have become more streamlined, encouraging manufacturers to introduce advanced hemostatic solutions. This regulatory environment fosters innovation and competition, leading to a wider array of products available in the market. As new technologies emerge, healthcare providers are likely to adopt these innovations to improve surgical outcomes. The hemostasis tissue-sealing-agents market stands to gain from this trend, as regulatory support enhances the availability of effective products that meet the evolving needs of the healthcare sector.