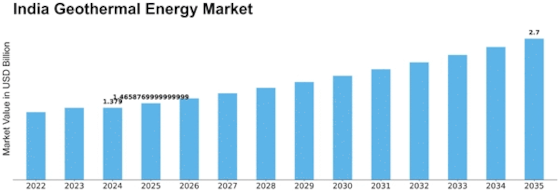

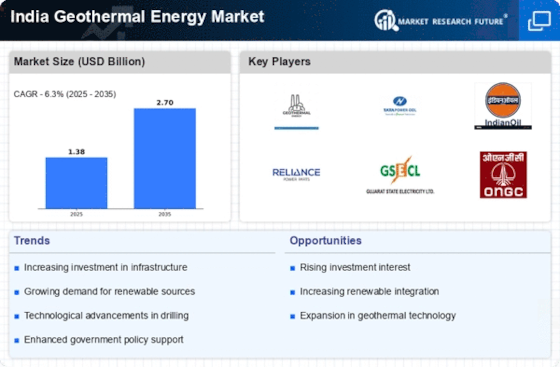

India Geothermal Energy Size

India Geothermal Energy Market Growth Projections and Opportunities

The Indian geothermal energy market is poised for significant growth, driven by a combination of factors that underscore the country's commitment to sustainable and renewable energy sources. One of the key market factors contributing to this growth is the vast geothermal potential present in various regions of India. The country boasts several geothermal hotspots, including the Himalayan region, the western coast, and parts of Rajasthan. These areas exhibit promising geothermal reservoirs that can be tapped for energy production. The abundance of such resources sets the stage for India to harness geothermal power as a reliable and sustainable source of energy.

Government initiatives and policies play a pivotal role in shaping the geothermal energy market in India. The Indian government has been actively promoting renewable energy through various schemes and incentives, fostering a conducive environment for the development of geothermal projects. Policies like the National Geothermal Policy provide a framework for the exploration and exploitation of geothermal resources, encouraging private and public investment in the sector. This regulatory support is essential in attracting stakeholders and fostering a robust market ecosystem for geothermal energy in India.

The increasing awareness and commitment to reducing carbon emissions also contribute significantly to the growth of the geothermal energy market. As India grapples with the challenges of climate change, there is a growing emphasis on shifting towards cleaner and greener energy alternatives. Geothermal energy, being a low-carbon and environmentally friendly option, aligns well with India's sustainability goals. The demand for clean energy solutions has spurred interest in geothermal projects as a reliable and constant source of power, making it an integral component of India's renewable energy portfolio.

Technological advancements and innovations play a crucial role in unlocking the full potential of geothermal energy in India. As technology continues to evolve, the cost of geothermal power generation is expected to decrease, making it more economically viable. Improved drilling techniques, enhanced reservoir characterization, and efficient power conversion technologies contribute to the overall competitiveness of geothermal energy. These technological advancements not only increase the efficiency of geothermal projects but also make them more attractive to investors, further fueling the market growth.

Investment and financing options are key determinants in the development of the geothermal energy market in India. With the increasing interest in renewable energy, both domestic and international investors are exploring opportunities in geothermal projects. Financial institutions and government-backed funds are playing a crucial role in providing the necessary capital for the development and implementation of geothermal projects. The availability of affordable financing options is instrumental in overcoming the initial capital barriers associated with geothermal exploration and development.

Global collaborations and partnerships also contribute to the growth of the geothermal energy market in India. Collaborations with international organizations and countries bring in valuable expertise, technology transfer, and financial support. These partnerships facilitate knowledge exchange and create a platform for joint research and development initiatives. The exchange of best practices and experiences accelerates the growth of the geothermal sector, positioning India as a key player in the global transition towards sustainable energy sources.

The Indian geothermal energy market is driven by a combination of factors that include abundant geothermal potential, supportive government policies, environmental concerns, technological advancements, investment opportunities, and global collaborations. As these factors align, the geothermal energy sector in India is poised to play a significant role in the country's energy mix, contributing to a more sustainable and cleaner future.

Leave a Comment