Rising Research Activities

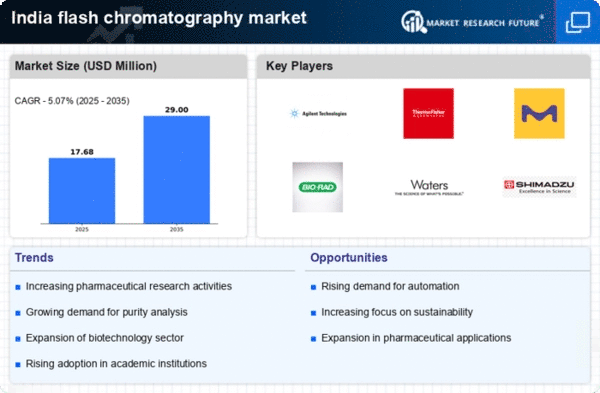

The flash chromatography market in India is experiencing growth due to an increase in research activities across various sectors, particularly in pharmaceuticals and biotechnology. Research institutions and universities are investing significantly in advanced separation techniques, which enhances the demand for flash chromatography systems. The market is projected to grow at a CAGR of approximately 10% over the next five years, driven by the need for efficient and rapid purification methods. This trend indicates a shift towards more sophisticated analytical techniques, as researchers seek to improve the quality and yield of their products. Furthermore, collaborations between academic institutions and industry players are likely to foster innovation in the flash chromatography market, leading to the development of new applications and technologies that cater to the evolving needs of researchers.

Growing Environmental Concerns

Environmental sustainability is becoming increasingly important in the flash chromatography market, as industries seek to minimize their ecological footprint. The demand for greener and more sustainable separation techniques is rising, prompting manufacturers to develop eco-friendly chromatography solutions. Flash chromatography, known for its efficiency and reduced solvent consumption, aligns well with these sustainability goals. Companies are likely to invest in technologies that not only enhance performance but also adhere to environmental regulations. This shift towards sustainable practices may drive the growth of the flash chromatography market, as organizations prioritize environmentally responsible methods in their operations. The integration of sustainability into business strategies could potentially reshape the competitive landscape of the market.

Emerging Startups and Innovation

The flash chromatography market in India is witnessing a surge in innovation, primarily driven by emerging startups that are focusing on developing novel separation technologies. These startups are leveraging advancements in materials science and engineering to create more efficient and cost-effective chromatography systems. The influx of new players is fostering competition, which may lead to reduced prices and improved product offerings in the market. Additionally, these innovative solutions are likely to cater to niche applications, expanding the overall market potential. As the startup ecosystem continues to thrive, it is expected that the flash chromatography market will benefit from fresh ideas and approaches that address specific challenges faced by researchers and industries alike.

Increased Focus on Quality Control

Quality control remains a critical aspect in the flash chromatography market, particularly in the pharmaceutical and food industries in India. Regulatory bodies are enforcing stringent quality standards, which necessitate the use of advanced analytical techniques for product testing and validation. Flash chromatography offers rapid and efficient separation, making it an ideal choice for quality assurance processes. As companies strive to meet compliance requirements, the demand for flash chromatography systems is expected to rise. The market is likely to witness a surge in investments aimed at upgrading laboratory equipment to ensure adherence to quality standards. This focus on quality control not only enhances product safety but also boosts consumer confidence, thereby driving the growth of the flash chromatography market.

Expansion of Pharmaceutical Manufacturing

The expansion of pharmaceutical manufacturing in India is a key driver for the flash chromatography market. As the country positions itself as a global hub for drug production, the need for efficient purification and separation techniques becomes paramount. Flash chromatography offers rapid processing times and high purity levels, making it an attractive option for pharmaceutical companies. the market is projected to grow as manufacturers seek to optimize their production processes and meet increasing global demand.. Furthermore, the Indian government's initiatives to boost the pharmaceutical sector, including financial incentives and infrastructure development, are likely to further stimulate the flash chromatography market. This expansion not only supports local industries but also enhances India's competitiveness in the global pharmaceutical landscape.