Increasing Cyber Threat Landscape

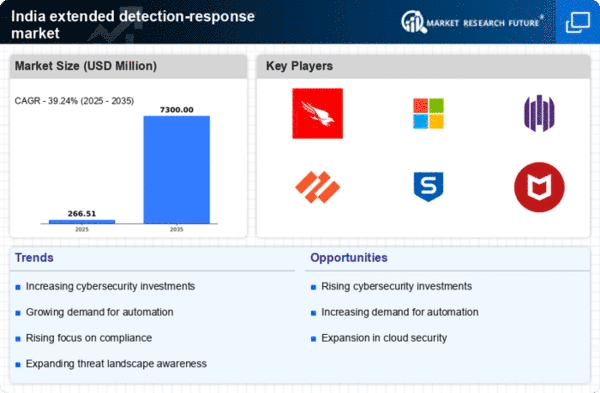

The extended detection-response market in India is experiencing growth due to the escalating cyber threat landscape. With cyberattacks becoming more sophisticated, organizations are compelled to adopt advanced security measures. Reports indicate that cybercrime costs could reach $10.5 trillion annually by 2025, prompting businesses to invest in extended detection-response solutions. This market is projected to grow at a CAGR of 20% from 2023 to 2028, as companies seek to enhance their security posture. The need for comprehensive threat detection and response capabilities is driving demand for integrated solutions that can address various attack vectors. As organizations recognize the importance of proactive security measures, the extended detection-response market is expected to expand significantly in India.

Growing Awareness of Cybersecurity Risks

There is a notable increase in awareness regarding cybersecurity risks among Indian businesses, which is significantly impacting the extended detection-response market. As high-profile data breaches and cyber incidents make headlines, organizations are becoming more vigilant about their security measures. Surveys indicate that over 70% of Indian companies consider cybersecurity a top priority, leading to increased investments in advanced security solutions. This heightened awareness is driving the demand for extended detection-response capabilities, as businesses seek to mitigate risks and protect sensitive information. The market is expected to grow at a rate of 18% annually, as organizations recognize the necessity of comprehensive security strategies. This trend underscores the importance of proactive threat detection and response in safeguarding organizational assets.

Regulatory Compliance and Data Protection

In India, the extended detection-response market is significantly influenced by the increasing emphasis on regulatory compliance and data protection. The introduction of stringent data protection laws, such as the Personal Data Protection Bill, has heightened the need for organizations to implement robust security frameworks. Companies are now investing in extended detection-response solutions to ensure compliance with these regulations and to avoid hefty fines. The market for compliance-related security solutions is expected to grow by 15% annually, as businesses prioritize data security. This trend indicates a shift towards integrated security solutions that not only protect data but also facilitate compliance with evolving legal requirements. Consequently, the extended detection-response market is poised for substantial growth as organizations navigate the complexities of regulatory landscapes.

Adoption of Cloud-Based Security Solutions

The shift towards cloud computing in India is a pivotal driver for the extended detection-response market. As organizations increasingly migrate their operations to the cloud, the demand for cloud-based security solutions is surging. It is estimated that the cloud security market will reach $12 billion by 2026, reflecting a CAGR of 25%. This transition necessitates advanced detection and response capabilities to safeguard cloud environments from potential threats. Organizations are recognizing that traditional security measures may not suffice in cloud settings, leading to a growing reliance on extended detection-response solutions. The integration of these solutions with cloud infrastructure is becoming essential for maintaining security and compliance, thereby propelling the extended detection-response market forward.

Investment in Digital Transformation Initiatives

The ongoing digital transformation initiatives across various sectors in India are acting as a catalyst for the extended detection-response market. As organizations embrace digital technologies, they are also exposed to new cybersecurity challenges. The digital transformation market is projected to reach $100 billion by 2025, with a significant portion allocated to security solutions. Companies are increasingly aware that digital growth must be accompanied by robust security measures, leading to a surge in demand for extended detection-response solutions. This investment in security is essential for protecting digital assets and ensuring business continuity. As organizations navigate their digital journeys, the extended detection-response market is likely to see substantial growth, driven by the need for integrated security frameworks.