Rising Urbanization

The rapid urbanization in India is a pivotal driver for the excavators market. As cities expand, the demand for construction and infrastructure development escalates. Urban areas are witnessing a surge in residential and commercial projects, necessitating the use of excavators for efficient earthmoving and site preparation. According to recent data, urbanization in India is projected to reach 600 million people by 2031, which could lead to a substantial increase in construction activities. This trend indicates a growing need for advanced machinery, including excavators, to meet the demands of urban development. Consequently, the excavators market is likely to experience significant growth as construction companies invest in modern equipment to enhance productivity and efficiency.

Mining Sector Expansion

The expansion of the mining sector in India is another significant driver influencing the excavators market. With the increasing demand for minerals and resources, mining companies are investing in advanced machinery to enhance operational efficiency. Excavators play a vital role in mining operations, facilitating the extraction and transportation of materials. The Indian mining industry is projected to grow at a CAGR of 6.5% over the next five years, indicating a robust demand for excavators. This growth is likely to be fueled by the government's focus on increasing domestic production of minerals, which may further bolster the excavators market as companies seek to upgrade their equipment.

Environmental Regulations

The implementation of stringent environmental regulations in India is shaping the excavators market. As the government emphasizes sustainable construction practices, there is a growing demand for eco-friendly machinery. Excavators equipped with low-emission engines and energy-efficient technologies are becoming essential for compliance with environmental standards. The market is witnessing a shift towards greener alternatives, as construction companies seek to minimize their environmental footprint. This trend indicates a potential growth area for the excavators market, as manufacturers develop and promote equipment that aligns with regulatory requirements and sustainability goals.

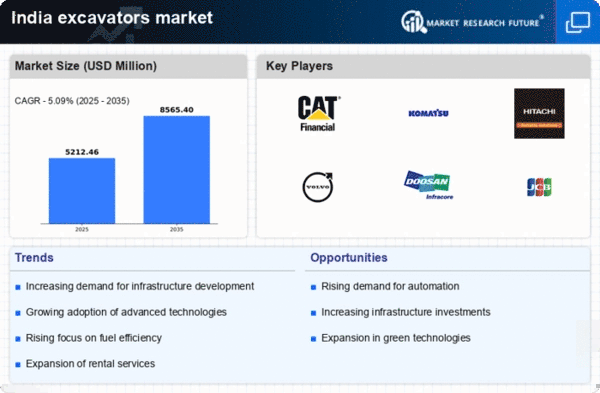

Infrastructure Investment

The Indian government's commitment to infrastructure investment serves as a crucial driver for the excavators market. With initiatives aimed at enhancing transportation networks, including roads, railways, and airports, the demand for heavy machinery is expected to rise. The government has allocated substantial budgets for infrastructure projects, with an estimated investment of $1.4 trillion planned for the next five years. This influx of capital is likely to stimulate the construction sector, leading to increased procurement of excavators. As infrastructure projects progress, the excavators market is poised for growth, driven by the need for reliable and efficient machinery to support large-scale construction efforts.

Technological Integration

The integration of advanced technologies in construction equipment is transforming the excavators market. Innovations such as telematics, automation, and fuel-efficient engines are becoming increasingly prevalent in excavators. These technologies not only enhance operational efficiency but also reduce operational costs for construction companies. As the industry moves towards digitization, the demand for technologically advanced excavators is expected to rise. Companies are likely to invest in modern machinery that offers improved performance and sustainability. This trend suggests that the excavators market will continue to evolve, driven by the need for innovative solutions that meet the challenges of contemporary construction practices.